Managing your finances is an essential part of life, but keeping track of all the details can be hard. One way to make this easier is by summing up your receipts. Summing up your receipts can help you stay organized and on top of your budget while also providing valuable insights into where you’re spending your money. This article will explain the benefits of summarizing your receipts and why it’s worth doing.

Benefits of Summing Up Receipts

Summing up your receipts can be incredibly helpful for managing your finances. Here are a few of the benefits:

Improved Organization

Keeping track of all your receipts can become overwhelming if you don’t organize them properly. Summing up your receipts into categories and classes will allow you to quickly and easily find the information you need and stay on top of your budget.

increased Visibility

Summarizing your receipts also provides a better understanding of where you are spending your money and can alert you to any discrepancies or changes that may have occurred. This can be especially helpful if you’re tracking expenses for business purposes, as it will allow you to quickly identify areas where you may need to adjust your budget to maximise your profits.

Regarding tax time, summarizing your receipts can make the process much easier. Having all of your expenses organized into categories and classes can help you identify areas where you can take advantage of deductions or credits and quickly determine how much money you need to set aside for taxes.

Improved Book Keeping

Easier Tax Preparation

Summarizing your receipts can help you maintain better records for both personal and business purposes. Keeping track of your expenses may be necessary for tax returns and providing a more accurate picture of your income and spending patterns over time. This can be especially helpful if you need to review or audit past financial transactions.

Enhanced Security

Summarising your receipts can help you protect yourself from identity theft or fraudulent charges. Regularly summarising and sorting your receipts, you’ll be able to quickly identify any suspicious activity and take the necessary steps to protect yourself.

Summing up your receipts is a great way to stay organized, improve visibility into where you spend your money, and make tax time easier. Additionally, summarizing your receipts can help you keep better records and enhance security against fraud or identity theft. All of these benefits make summing up your receipts a worthwhile endeavour.

Types of Receipts

Receipts come in various forms, each catering to the evolving landscape of transactions in today’s digital age. The type of receipt can influence how efficiently you manage your finances. Here are three common types of receipts:

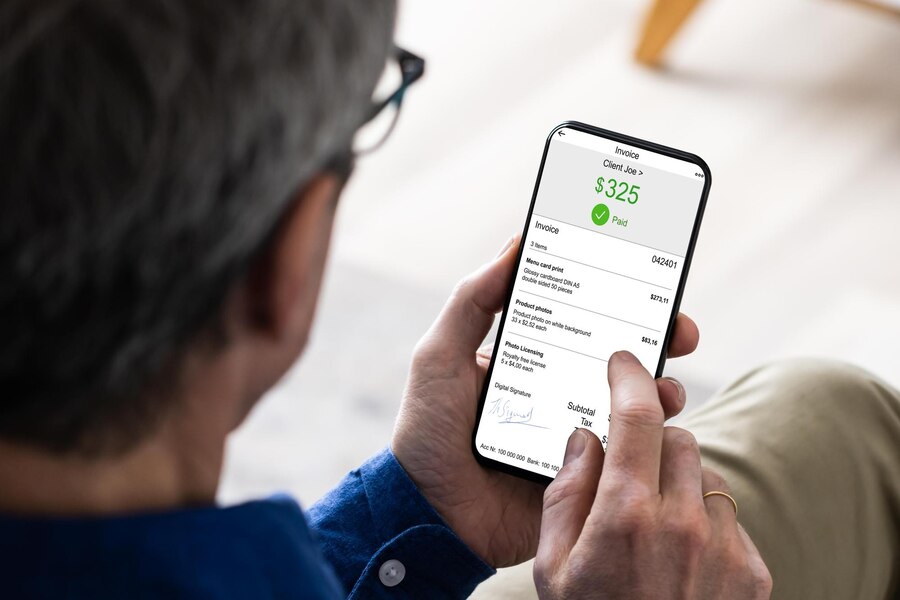

Digital Receipts

Digital receipts, electronic or e-receipts, are becoming increasingly popular as paperless transactions gain traction. These digital records of a purchase or transaction are sent directly to the customer’s email rather than printed on paper. They offer numerous benefits, including reducing paper waste, eliminating the need to store physical receipts, and providing a convenient way to track and organize expenses.

Digital receipts also make it easier to return or exchange items as they can be easily accessed and presented without needing a physical copy. From a business perspective, digital receipts help streamline operations, reduce costs, and provide valuable data on customer purchases and preferences. As technology advances, digital receipts are expected to become even more prevalent, further revolutionizing the way transactions are documented and managed.

Paper Receipts

Paper receipts are a common proof of purchase, typically given to customers after a transaction. These receipts usually contain important information such as the date of purchase, the items bought, the total amount paid, and the payment method. Paper receipts serve as a record for both the customer and the seller, providing a way to track expenses, reconcile accounts, and return or exchange items.

While paper receipts are convenient for documenting transactions, they can also contribute to environmental waste. With the increasing popularity of digital receipts and online transactions, many businesses and consumers opt for electronic receipts to reduce paper usage. However, paper receipts are still widely used and serve as tangible proof of purchase for many individuals. Overall, paper receipts are an integral part of the retail experience, providing a physical record of transactions that can be useful for budgeting, expense tracking, and returns.

Smart Receipts

Smart Receipts is a mobile app designed to help users easily track their expenses and manage their receipts. With this app, users can capture and store digital copies of their receipts and categorize and itemize their expenses. Smart Receipts also allows users to create expense reports and export the data to a spreadsheet or other file format.

The app’s features include automatic currency conversion, OCR (optical character recognition) for easy receipt scanning, and the ability to customize expense categories. Smart Receipts is especially useful for business travellers, freelancers, and anyone who needs to keep track of their expenses for personal or professional purposes. Overall, Smart Receipts offers a convenient and efficient way to organize and manage receipts, making it easier for users to stay on top of their finances.

Pros and Cons of Summing Up Receipts

Working from home has become increasingly popular, especially with the rise of technology and remote collaboration tools. There are several pros and cons to consider when working from home:

Pros:

- Flexibility: Working from home allows for a more flexible schedule, allowing individuals to choose when to work.

- Comfort: Working from the comfort of one’s home can increase productivity and reduce stress.

- Cost-saving: Working from home eliminates the need to commute, saving time and money on transportation expenses.

- Work-life balance: Having the flexibility to work from home can lead to a better balance between work and personal life.

Cons:

- Distractions: Working from home can present many distractions, such as household chores, pets, or family members.

- Isolation: Without the social interaction of working in an office, individuals may feel isolated and lonely.

- Lack of structure: Some individuals may struggle with the lack of a structured work environment, leading to decreased productivity.

- Boundaries: It can be challenging to separate work and personal life when working from home, leading to potential burnout.

How to Sum Up Your Receipts

It is important to keep track of your receipts to maximize the benefits associated with them. Summing up your receipts can help you stay organized and on top of your finances. Here are some steps you can take to sum up your receipts:

- Develop an effective system for organizing and storing your paper or digital receipts. If you’re using paper, consider using a filing cabinet or folder to store them. If you’re using digital receipts, create a system for categorizing them and organizing them into folders.

- Record your expenses as they occur to track your spending on certain items or services. This will help you stay on top of your budget and ensure you’re not exceeding your spending limits.

- Once you have a system, it’s time to start summing up your receipts. This can involve manually adding up the total cost of each item or using software such as Smart Receipts to automate the process.

Summing up your receipts is important to staying organized and keeping track of your finances. By taking the time to sum up your receipts, you will gain a better understanding of how much you’re spending and where your money is going. This can help you save money in the long run and ensure you make smart choices with your finances.

Smart Receipts is also an invaluable tool for tracking expenses over time. Using the app, to sum up your receipts, you can easily gain an overview of how much you have spent on a particular item or service in a certain period. This information can identify areas where you may be spending too much money and help you develop a plan to cut back on unnecessary costs. Additionally, Smart Receipts can be used to generate reports that can be shared with other parties, such as an accountant or financial advisor.

Overall, summing up your receipts is a great way to take control of your finances and ensure that you are staying on top of your budget. With the help of apps like Smart Receipts, the process has never been easier. Take action today and start summing up your receipts to maximize your cost savings and improve the health of your finances.