An iPhone card reader is a small device that allows you to accept card payments directly through your iPhone. It connects to your phone’s charging port and transforms it into a secure card payment terminal. As a business owner or freelancer, you can now accept customer payments anywhere and anytime.

One of the key benefits of an iPhone card reader is its compatibility. It can work with various cards, including credit cards, debit cards, and contactless payments. This versatility ensures you can cater to different customer preferences and provide a seamless payment experience.

iPhone card readers come equipped with a range of features and functions. They can securely capture card information, process payments, and email receipts directly to your customers. Some card readers even allow you to link your American Express and other credit card brands to your device, making it incredibly convenient for you and your customers.

Quick Links

- Square Reader

- Revolut Reader

- Zettle Reader

- SumUp Air

- Shopify WisePad 3

- Why You need a card reader for iPhone

|  |  |  |  |  |

Square Reader | Revolut Reader | Zettle | SumUp | Shopify WisePad 3 | |

Rating | |||||

Pricing/ | £39 | £49 | £29–£59 | £19 | £49 |

Transaction Fees | 1.75% / 2.5% | 0.8-2.6% + 2p | 1.75% | 1.69% | 1.5-1.7% |

Connectivity | Wi-Fi, Bluetooth | Wi-Fi, Bluetooth | Wi-Fi, Bluetooth | Wi-Fi, Bluetooth | Wi-Fi, Bluetooth |

Square Reader

In the bustling world of commerce, where flexibility meets functionality, Square Reader emerges as a beacon of innovation for small to medium-sized businesses. This elegantly designed, square-shaped marvel is more than just a card reader; it’s your gateway to seamless transactions. With its plug-and-play compatibility across iPhone, iPad, and Android devices, Square Reader handles chip and contactless payments with unparalleled ease. Its light footprint belies its powerful capabilities, offering you the most feature-rich companion app in the market: the Square Point of Sale.

Features

Versatile Payments: Accept chip and contactless payments effortlessly, with PIN entry conveniently managed on your mobile device.

Universal Compatibility: Designed to work seamlessly with iPhone, iPad, and Android devices, ensuring your business is never tethered.

Comprehensive App: Square Point of Sale, the accompanying app, is a treasure trove of features designed to streamline your operations, from inventory management to transaction processing.

Peripheral Connectivity: Extend your capabilities with connections to receipt printers, kitchen printers, cash drawers, and barcode scanners, making your business truly versatile.

Robust App Ecosystem: Beyond the basics, dive into advanced features with the free Point of Sale app. Manage your inventory, staff schedules, and more with ease and precision.

Employee Management: Empower your team with the Square Team app, allowing for easy logging of hours and access to additional employee management features.

Pricing

| Item | Price | Notes |

|---|---|---|

| Square Reader | £19 + VAT | One-time purchase |

| Charging Dock | £25 + VAT | Optional accessory |

| Transaction Rate | 1.75% | Applies to all card payments |

| Monthly Fees | None | Pay-as-you-go, no contract lock-in |

| Additional Employee Features | £20/month per location | Via Square Team app |

Pros

- Affordability: With a low initial cost and no recurring monthly fees, it’s an economical choice for businesses of all sizes.

- Comprehensive Features: The Square Point of Sale app offers a wide array of functionalities, from sales tracking to inventory management, all designed to simplify your day-to-day operations.

- Ease of Use: Its intuitive design and compatibility make it accessible for anyone to use, reducing training time and streamlining transactions.

- Flexibility: No long-term contracts mean you can adapt your payment solutions as your business evolves without penalty

Cons

- Transaction Fee: While competitive, the 1.75% transaction rate may add up, particularly for businesses with high sales volumes.

- Hardware Cost: For businesses requiring multiple devices or those looking to utilise the full suite of compatible peripherals, initial costs can increase.

Square Reader is not just a tool; it’s a partner in your business’s growth, designed to adapt and grow with you. Whether you’re ringing up sales at a local market or managing a bustling cafe, Square Reader offers the technology, flexibility, and support you need to succeed.

Revolut Reader

Revolut Reader steps into the financial ecosystem as a fresh addition for businesses seeking a streamlined approach to handling payments. Designed specifically for Revolut Business account holders, this compact device offers a straightforward solution for efficiently accepting contactless and chip card payments. While its physical design might speak to a more minimalist approach, its integration with Revolut’s fast-paced financial services marks it as a contender for businesses that prioritise speed and simplicity in their transactions.

Features

Rapid Transaction Processing: Payments clear within 24 hours, directly into your Revolut Business account, ensuring swift access to funds.

Broad Card Compatibility: Accepts a wide range of payment methods including Visa, Mastercard, contactless payments, as well as mobile wallets like Apple Pay and Google Pay.

Integrated Business Tools: Though primarily designed for payment processing, it offers integration with Revolut’s suite of business tools and the ability to itemise bills through a product catalogue.

Hospitality POS Integration: Works in tandem with Nobly’s hospitality POS system, providing an additional layer of utility for service-oriented businesses.

Pricing

| Item | Price | Notes |

|---|---|---|

| Device Cost | £49 + VAT | Excludes mandatory £5 shipping fee |

| Transaction Fees (Domestic consumer Visa and Mastercard) | 0.8% + £0.02 | For UK consumer cards |

| Transaction Fees (All other cards) | 2.6% + £0.02 | Includes international and corporate cards |

| Revolut Business Account (Basic) | Free | Optional subscription upgrades available for enhanced business tools |

| Revolut Business Account (Subscription Upgrades) | Varies | Excludes POS functionalities |

Pros

Cost-Effective: Competitive transaction fees for UK consumer cards, making it an attractive option for domestic businesses.

Fast Payouts: Quick turnaround for accessing funds, with payouts typically processed within 24 hours.

Integration with Revolut Business: Seamless connection with Revolut’s broader business account features, offering a cohesive financial management experience.

Cons

Customer Support: Experiences with customer support can vary, with some users reporting slow response times.

App Functionality: The associated app is noted to be quite basic, lacking in advanced point-of-sale features.

Approval Process: The need for separate approval for a Merchant Account adds an extra step to getting started, which can delay setup.

The Revolut Reader, while modest in appearance and functionality, is a robust tool for businesses already entrenched in the Revolut ecosystem. Its strengths lie in its rapid processing and low rates for domestic transactions, offering a straightforward, no-frills approach to payment acceptance. However, businesses in search of more sophisticated POS features or immediate, comprehensive support might find it lacking. For those already leveraging Revolut Business accounts and in need of a simple, effective payment solution, the Revolut Reader presents a viable option, especially as it continues to evolve with new features and integrations.

Zettle Reader

The Zettle Reader stands out in the competitive landscape of card payment solutions with its combination of ergonomic design and user-friendly functionality. Celebrated for its seamless integration into the daily operations of businesses across the UK, this device offers a no-frills, straightforward approach to payment processing. Despite recent concerns over its development trajectory, the Zettle Reader continues to be a popular choice, thanks to its comprehensive card compatibility and the absence of recurring fees.

Features

Ergonomic Design: Designed for comfort, the Zettle Reader is compact, lightweight, and fits perfectly in the palm of your hand, featuring an accessible PIN pad.

Wide Card Compatibility: Accepts a broad array of card types including Visa, Mastercard, American Express, and many more, along with contactless payments and mobile wallets like Apple Pay, Google Pay, and Samsung Pay.

Integration Capabilities: Works effortlessly with various POS systems and accounting software, enhancing its utility for a range of business models.

Free POS App: The Zettle Go app supports essential sales functions, including inventory management, sales reporting, and invoicing, without additional costs.

Pricing

| Item | Price | Notes |

|---|---|---|

| First Zettle Reader | £29 + VAT | Additional units £59 + VAT each |

| Transaction Fee | 1.75% | Applies to all card types |

| Optional Charging Stand (Zettle Dock) | Not specified | Enhances countertop usage |

Pros

- Cost-Efficient: Attractive upfront cost with no monthly fees or contractual lock-ins, offering an economical choice for businesses.

- User-Friendly: The device is renowned for its ergonomic design, making it one of the most comfortable card readers on the market.

- Broad Acceptance: Supports a wide range of card brands and payment methods, ensuring versatility in transaction processing.

- No Lock-In: Flexibility to use without the commitment of long-term contracts.

Cons

- Limited Development: Since PayPal’s acquisition of Zettle, there has been a noticeable lack of new features or significant app development.

- Restricted Support Hours: Customer service is only available on weekdays during standard business hours, which might not align with the needs of all businesses.

- Concerns Over Longevity: The future of the product is uncertain, given the current state of development, which might affect businesses looking for a long-term solution.

SumUp Air

SumUp Air emerges as a standout solution in the realm of payment processing, offering a sleek design combined with a host of functional extras that cater to the modern merchant. Renowned for its straightforward usability and the cleanliness of its glass PIN pad, the SumUp Air card reader is a testament to the blend of aesthetics and efficiency. This device not only supports a wide range of payment options but also boasts an impressive battery life, ensuring that businesses can keep transactions flowing with minimal interruption.

Features

Hygienic Design: The SumUp Air features a smooth glass surface over the PIN pad, making it exceptionally easy to clean and maintain.

Broad Compatibility: Accepts a vast array of payment types, including chip, contactless, and mobile wallets from most major card brands.

SumUp App: A simple yet powerful POS system that includes a product library, user accounts, sales overview, and payout reports, alongside various online payment options.

Flexible Payment Solutions: Offers the ability to send email invoices and payment links, set up a basic online store, and even sell e-gift cards.

Next-Day Payouts: With the free SumUp Card, transactions are accessible the day after, including weekends. Traditional bank account payouts are processed within 1-3 working days.

Pricing

| Item | Price | Notes |

|---|---|---|

| SumUp Air Reader | £39 + VAT | No monthly fees or contractual commitment |

| SumUp Air Reader & Stand Bundle | £49 + VAT | Stand enhances countertop usage |

| Transaction Fee | 1.69% | Applies to all card types |

Pros

- Cost-Efficient: Competitive pricing with a low transaction fee and no monthly fees or lock-in contracts.

- Ease of Use: The reader’s design facilitates easy cleaning, and its long battery life reduces the need for frequent charging.

- Versatile Payment Options: Supports a wide variety of payment methods, enhancing the customer payment experience.

- Comprehensive Support: Customer support is readily available on both weekdays and weekends.

Cons

- Basic POS Features: While the SumUp App provides essential functionalities, its POS features are relatively basic.

- Limited Integrations: Currently, there are very few options for integrating the system with external accounting software or other business tools.

SumUp Air positions itself as a highly attractive option for businesses looking for a user-friendly, efficient, and hygienic card payment solution. With its competitive pricing and broad range of payment acceptance, it suits a variety of business needs. While its POS features may be basic and integrations limited, the overall value offered by SumUp Air, particularly for small to medium-sized businesses, is significant.

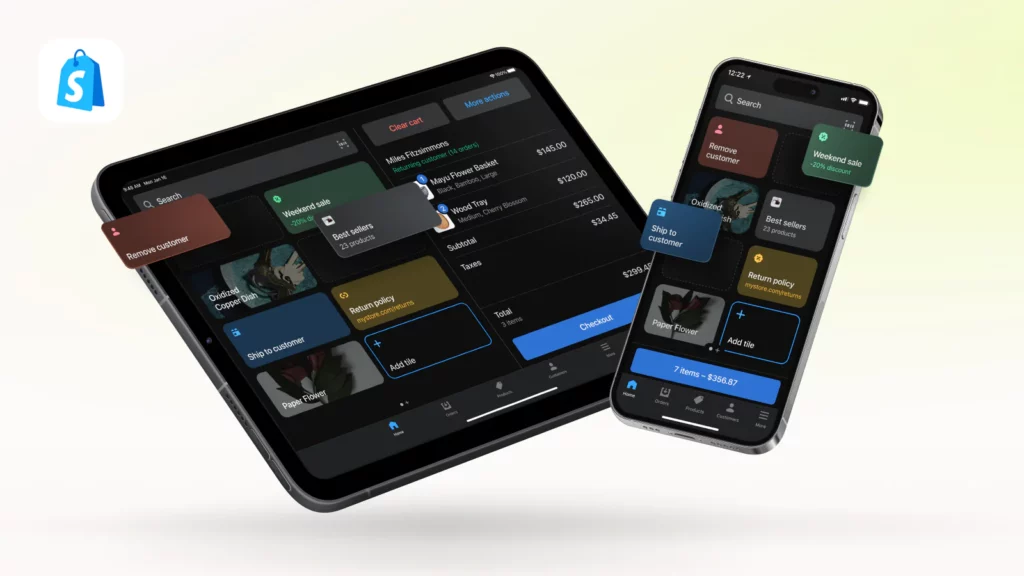

Shopify WisePad 3

Shopify WisePad 3 stands as a beacon of innovation for businesses seeking a harmonious blend of in-store and online sales capabilities. As an extension of Shopify’s renowned ecommerce platform, the WisePad 3 card reader offers a seamless integration with Shopify Payments, encapsulating a robust solution for merchants aiming to optimise their omnichannel approach.

While designed with quality in mind, its compact PIN pad may pose challenges for users with larger hands, yet its overall functionality and support aim to streamline the payment process across all channels.

Features

E-commerce Integration: Directly integrates with Shopify’s e-commerce platform, providing a unified system for both online and physical store sales.

Omnichannel Functionality: The Shopify POS app, available in Lite and Pro versions, offers features that enhance customer service through omnichannel sales strategies, including Click & Collect.

24/7 Customer Support: Round-the-clock assistance ensures that businesses can get help whenever needed, complemented by comprehensive online guides.

Accepted Payment Methods: Supports various cards and payment options, including Visa, Mastercard, American Express, contactless payments, Apple Pay, and Google Pay.

Pricing

| Item | Price | Notes |

|---|---|---|

| WisePad 3 Reader | £49 + VAT | Requires Shopify ecommerce subscription |

| Basic Shopify Plan | £25 monthly | Plus 1.7% transaction fee |

| Shopify Plan | £65 monthly | Plus 1.6% transaction fee |

| Advanced Shopify Plan | £344 monthly | Plus 1.5% transaction fee |

| Shopify POS Pro Upgrade | £69 monthly per location | Additional to the ecommerce subscription |

Pros

Quality Hardware: The WisePad 3 is noted for its good build quality, ensuring durability and reliability.

Comprehensive Support: Access to 24/7 customer support provides peace of mind for businesses operating round-the-clock.

Omnichannel Features: The Shopify POS app offers advanced features for businesses looking to unify their in-store and online sales processes.

Cons

Subscription Requirement: Utilising the WisePad 3 and Shopify Payments system necessitates an ongoing Shopify ecommerce subscription, which may not be cost-effective for all businesses.

Cost Considerations: The card reader and associated subscription fees present a higher upfront and ongoing cost compared to some alternatives.

PIN Pad Size: The smaller PIN pad might not be user-friendly for everyone, particularly those with larger hands.

Why You need a card reader for iPhone

If you are a business owner or an entrepreneur looking for a convenient and versatile payment solution, getting an iPhone card reader is a wise choice. These card readers are compatible with various types of cards, including credit cards, debit cards, and contactless payments, but they also come equipped with various features and functions. This article will explore why you should consider getting an iPhone card reader and how it can benefit your business. From seamless payment experiences to enhanced security measures, an iPhone card reader offers many advantages that can elevate your business operations. Let’s explore these benefits in detail.

Low costs

One of the key reasons why you should consider getting an iPhone card reader is because of the low costs associated with it. Unlike traditional payment solutions, an iPhone card reader typically has a one-time purchase cost with no recurring fees. This means that once you invest in the card reader, you won’t have to worry about continuously paying for it, resulting in significant savings in the long run.

Additionally, iPhone card readers often offer competitive transaction fees, contributing to the low costs. These transaction fees are usually much lower than other payment solutions, making it a cost-effective option for businesses of all sizes.

By opting for an iPhone card reader, you save on the upfront purchase cost and minimise ongoing expenses associated with payment processing. This can make a significant difference in your overall financial management and profitability.

In summary, choosing an iPhone card reader provides a cost-efficient solution for accepting payments. Its one-time purchase cost and competitive transaction fees allow you to save money and allocate those resources elsewhere in your business.

Free point-of-sale system

One of the key benefits of getting an iPhone card reader is the inclusion of a free point-of-sale system. This system is a valuable asset for businesses of all sizes, providing many benefits.

First and foremost, the free point-of-sale system allows users to accept payments from various cards, including credit, debit, and contactless cards. This convenience enables businesses to cater to the diverse preferences of their customers and provide a seamless payment experience.

In addition, this system eliminates the need for additional costs associated with other payment solutions. With an iPhone card reader, there are no hidden fees or subscription charges, allowing businesses to save on overall expenses.

Moreover, the free point-of-sale system allows users to manage sales data anywhere. This means that businesses can access real-time transaction information, generate detailed reports, and track inventory, all from the convenience of their iPhones. This level of flexibility and accessibility empowers businesses to make informed decisions and streamline their operations.

Moreover, the free point-of-sale system allows users to manage sales data anywhere. This means that businesses can access real-time transaction information, generate detailed reports, and track inventory, all from the convenience of their iPhones. This level of flexibility and accessibility empowers businesses to make informed decisions and streamline their operations.

In conclusion, the free point-of-sale system provided by iPhone card readers offers a range of benefits. This system is invaluable for businesses looking to enhance their payment processing capabilities, from accepting payments from various cards to eliminating additional costs and enabling remote sales data management.

Accept a wide range of cards.

An iPhone card reader allows you to accept various cards, including credit cards, debit cards, contactless payment methods, travel cards, and even rewards cards. This versatility is a great advantage for businesses catering to different customer preferences and providing a seamless payment experience.

By accepting credit cards, businesses can give their customers the convenience of paying later, while debit cards allow instant fund transfers. Contactless payments, on the other hand, offer a quick and secure way to make transactions using smartphones or smartwatches. This feature is especially important in today’s fast-paced world, where customers seek efficiency.

Travel cards, such as transport or pre-paid cards used for public transportation, can also be accepted using an iPhone card reader. This capability is incredibly valuable as it allows businesses to serve commuters and travellers who rely on these cards for their daily commutes or trips.

Lastly, the ability to accept rewards cards through an iPhone card reader is a great advantage for businesses that offer loyalty programs. By accepting these cards, businesses can ensure their customers can easily redeem points and enjoy the benefits of their rewards program.

In conclusion, getting an iPhone card reader enables businesses to accept various cards, including credit cards, debit cards, contactless payments, travel cards, and rewards cards. This flexibility enhances the payment experience for customers and helps businesses meet their diverse preferences effectively.

No paperwork

One of the major benefits of using an iPhone card reader is the elimination of paperwork in transactions. With traditional payment methods, businesses often have to deal with physical receipts and manual record-keeping, which can be time-consuming and prone to human error. However, with the introduction of card reader technology, all of this can be streamlined into a digital process.

An iPhone card reader allows for the digital storage and tracking of sales data, eliminating the need for physical receipts and manual record-keeping. All transaction information can be securely stored in the device, making it easily accessible for future reference. This reduces clutter, improves organisation, and simplifies the accounting process.

By embracing this paperless system, businesses can experience several advantages. Firstly, reducing paperwork eliminates the need for storage space and the risk of losing important documents. Additionally, digitally tracking sales data enables businesses to easily analyse and monitor their financial performance, which can inform strategic decision-making.

In conclusion, getting an iPhone card reader is a smart choice for businesses looking to eliminate paperwork from their transactions. This technology’s digital storage and tracking capabilities simplify accounting processes, improve organisation, and reduce clutter. Embracing this paperless system can streamline operations, save time, and enhance efficiency for businesses of all sizes.

Expandable

One of the key reasons why you should consider getting an iPhone card reader is its expandable features. These card readers are not limited to just processing credit and debit card payments; they offer a wide range of functionalities that can be customised and enhanced according to your business needs.

With an iPhone card reader, you can easily integrate additional accessories or software to expand its capabilities. For example, you can pair it with a barcode scanner or receipt printer to streamline your sales process. This lets you provide your customers with printed receipts or even generate sales reports directly from your device.

Furthermore, the card reader can be customised to accept various payment methods, including contactless payments, Apple Pay, or online payments. This flexibility ensures customers have convenient payment options, boosting customer satisfaction and increasing sales opportunities.

Another advantage of an iPhone card reader is its scalability. As your business grows, you can easily scale up your payment processing capabilities by adding more card readers or upgrading your software. This means that you won’t be limited by the card reader’s capacity, ensuring you can meet the increasing demands of your growing customer base.

In conclusion, an iPhone card reader offers expandable features that can be customised and enhanced with additional accessories or software. Its scalability allows you to easily adapt to the changing needs of your business, making it a valuable tool for efficient payment processing.

Do everything on the Internet

One of the top reasons you should get an iPhone card reader is its convenience for performing all transactions and card-related tasks directly on the Internet. With an iPhone card reader, you can easily and efficiently complete online transactions, process payments, and manage card details.

The ability to do everything online means you can conduct business from anywhere. You no longer have to rely on physical card readers or payment terminals to process transactions. Instead, you can connect your iPhone card reader to the Internet and do all your online payment processing.

Managing your card details also becomes incredibly convenient with an iPhone card reader. You can securely store and access your card information through the card reader app, eliminating the need for physical cards. This means no more carrying around multiple cards or worrying about losing them. You can digitally manage and update your card details, saving time and effort.

In addition, an iPhone card reader allows for seamless integration with online payment platforms, making it easier for customers to make digital transactions. The iPhone card reader offers various options to cater to customer preferences, whether through contactless payments, Apple Pay, or other online payment methods.

In summary, getting an iPhone card reader lets you perform all transactions and manage card-related tasks directly on the Internet. It offers convenience, security, and flexibility, making it an indispensable tool for businesses and individuals.

Mobility

Mobility is one of the key advantages of using an iPhone card reader. With this innovative device, you can accept payments anywhere, allowing you to conduct business on the go or at pop-up events. The portability of the iPhone card reader allows you to bring your business directly to your customers, whether at a local fair, a market or even offering services at a client’s location.

Gone are the days of being tethered to a physical payment terminal or relying on cumbersome card readers. The iPhone card reader is designed to be lightweight and compact, making it easy to carry in your pocket or bag. Its small size means you can effortlessly take it wherever you need to go, enabling you to accept payments wherever your business takes you easily.

Adopting an iPhone card reader allows you to provide a convenient and seamless payment experience for your customers, no matter where you are. It allows you to stay connected and accept digital transactions on the spot. Embracing the mobility the iPhone card reader offers empowers you to extend your reach, increase sales, and cater to the growing demand for on-the-go payments.

Experience the freedom and flexibility of conducting business with an iPhone card reader anytime, anywhere. Embrace mobility and take your business to new heights while providing customers a convenient and efficient payment experience.

Perfect for short-term use

The iPhone card reader is perfect for short-term use due to its versatility and convenience. Whether hosting a pop-up shop or running a booth at a trade show, this device is an ideal solution for temporary or occasional sales situations.

One of the advantages of using the iPhone card reader for short-term use is its ease of setup. Connect the card reader to your iPhone, download the corresponding app, and you’re ready to start accepting payments. There’s no need for complicated installations or lengthy training sessions.

Portability is another key feature of the iPhone card reader. It is designed to be lightweight and compact, making it easy to carry around. Whether moving from one location to another or interacting with customers on the go, the iPhone card reader can conveniently fit in your pocket or bag.

The iPhone card reader offers a seamless payment experience for both you and your customers during short-term sales events. It accepts digital transactions, eliminating the need for cash or traditional card readers. With its user-friendly interface and secure payment processing, you can provide a convenient and efficient payment solution.

In conclusion, the iPhone card reader is the perfect choice for short-term use due to its advantages, ease of setup, and portability. Upgrade your business operations, embrace the mobility of the iPhone card reader, and enjoy a hassle-free payment experience for your temporary or occasional sales events.

Sales data available anywhere

One of the compelling reasons to invest in an iPhone card reader is the ability to access your sales data from anywhere. With this device, you can conveniently track and manage your sales performance.

The iPhone card reader allows you to access real-time sales reports, giving valuable insights into your business’s performance. Whether at a trade show, a pop-up event, or simply away from your physical store, you can keep tabs on how your business is doing.

Furthermore, you can conveniently check your inventory levels remotely with the iPhone card reader. This feature ensures you have enough stock to meet customer demand and avoid potential shortages. You can also make informed decisions about restocking and reordering based on accurate, up-to-date information.

Accessing sales data from anywhere with an iPhone card reader empowers you to stay on top of your business operations without being tied to a specific location. It provides flexibility and convenience, allowing you to monitor and manage your business efficiently.

In summary, getting an iPhone card reader enables you to access your sales data from anywhere, giving you the freedom and flexibility to keep track of your business’s performance and make informed decisions on the go.

Integrations

Integrations play a crucial role in streamlining business operations and enhancing efficiency. Regarding an iPhone card reader, the benefits extend beyond processing payments. This versatile device seamlessly integrates with various systems and platforms, making it a valuable tool for businesses of all sizes.

An iPhone card reader can integrate with popular accounting software, allowing you to sync transaction data and streamline your financial record-keeping automatically. With this integration, you can easily track revenue, manage expenses, and generate accurate reports, saving time and effort.

Moreover, the card reader can seamlessly integrate with e-commerce platforms, enabling you to accept payments online. Whether you have an online store or sell through social media platforms, this integration ensures a seamless payment experience for your customers, boosting sales and expanding your customer base.

In addition, integrating the iPhone card reader with a customer relationship management (CRM) system enhances your ability to track customer interactions, purchase history, and preferences. Maintaining a centralised customer information database can provide personalised experiences, strengthen customer loyalty, and drive repeat business.

With its integrations, an iPhone card reader empowers businesses to streamline processes, enhance financial management, and improve customer relationships. By leveraging its capabilities and connecting it to essential systems and platforms, you can optimise your operations, drive growth, and stay ahead of the competition.

Frequently Asked Questions

What should I consider when choosing an iPhone card reader?

When selecting an iPhone card reader, consider compatibility with your device and POS software, transaction fees, the range of accepted payment methods, and the reader’s cost. Also, think about the quality of customer support provided, the ease of setup and use, and any additional features that may benefit your business, such as inventory management or omnichannel selling capabilities.

Can I use any card reader with my iPhone?

Not all card readers are compatible with every iPhone model. Ensure the card reader you choose supports iOS and connects smoothly with your specific iPhone model, whether via Bluetooth, a physical connection, or Wi-Fi.

What are the costs associated with using an iPhone card reader?

Costs can include the initial purchase price of the card reader, transaction fees per sale, and potentially monthly subscription fees if the card reader is part of a larger POS system. Be sure to understand all the fees involved to calculate the overall cost effectively.

How secure are iPhone card readers?

Modern iPhone card readers are designed with security in mind, using encryption to protect card information during the transaction process. Look for readers that comply with PCI (Payment Card Industry) standards and offer end-to-end encryption for maximum security.

Do I need an internet connection to use an iPhone card reader?

While many card readers require an internet connection to process payments, some can operate in “offline mode,” storing transaction data to process once a connection is re-established. However, real-time processing will always require an internet connection via mobile data or Wi-Fi.

Can I accept all types of payments with an iPhone card reader?

Most iPhone card readers are designed to accept a wide range of payment methods, including magnetic stripe, chip (EMV), and contactless payments like Apple Pay and Google Pay. Ensure the reader you choose supports the payment types your customers are most likely to use.

How do I set up and start using an iPhone card reader?

Setup processes vary by device but typically involve connecting the card reader to your iPhone via Bluetooth or a physical connector, installing any necessary apps, and completing a simple configuration process. Follow the manufacturer’s instructions for the best results.

Is customer support readily available for iPhone card readers?

The level and availability of customer support depend on the card reader provider. Look for providers that offer comprehensive support through multiple channels, including phone, email, and live chat, ideally available 24/7 to assist with any issues that arise.

Final Words

In navigating the world of mobile payment solutions, the journey towards finding the perfect iPhone card reader for your business can feel like a blend of art and science. From sleek designs that fit comfortably in your hand to robust systems that seamlessly integrate with your existing ecommerce platforms, each card reader we’ve discussed offers a unique set of features tailored to different business needs. Whether you prioritise cost efficiency, compatibility, or the breadth of payment options, understanding the nuances of each option is crucial in making an informed decision.

As technology continues to evolve, the importance of selecting a card reader that not only meets your current needs but also anticipates future trends cannot be overstated. Whether you’re a small pop-up looking to process payments on the go or a burgeoning retail giant seeking to streamline your omnichannel sales, there’s a solution out there that fits. We invite you to share your thoughts, experiences, or questions in the comments below. Have you used any of these card readers? How have they impacted your business operations? Let’s discuss and help each other navigate the ever-changing landscape of mobile payments.