Are you tired of slow, unreliable, and difficult-to-use credit card machines causing long lines and frustrated customers at your business? You’re not alone. In today’s fast-paced world, a seamless payment process is not just an option; it’s necessary to keep your business thriving. Yet, many businesses struggle with outdated equipment that can’t meet their needs, leading to lost sales and dissatisfied customers.

Imagine the peak hours at your business, with customers waiting to make their purchases. Now, picture your credit card machine freezing up or taking forever to process a single transaction. Each second wasted tests your customers’ patience and puts a dent in your reputation and bottom line. It’s not just about the immediate inconvenience but the cumulative impact on customer loyalty and your brand’s image. In the digital age, word of fast service spreads fast, but word of slow service spreads even faster.

In this article, we’ll explore some of the best credit card machines on the market, designed to cater to various business needs. Whether you’re a small cafe looking to streamline your coffee sales or a large retailer seeking to enhance your checkout efficiency, there’s a solution that fits every requirement. Join us as we delve into these cutting-edge devices’ features, benefits, and potential impacts on your business operations and customer satisfaction.

Quick Links

|  |  |  |  |  |

Card Machine | Revolut Reader | Clover | Zettle Reader | Barclaycard Reader | Square |

Cost | Free | £12 | £Free | £0 | Free |

Processing Fees | £0.8% + £0.2 | 0.2% – 3.5% + 20p-40p | 1.75% | £20 | From 1.4% plus 25 pence |

Strenght | Low transaction fees | Access your money in minutes with Rapid Deposits | Has manual card entry for phone orders | 1.40% + 5p | No monthly fee |

Weakness | Only one card reader option | Loyalty programs not available with Clover Go | Only one credit card machine option, though it has full POS systems | 1.40% + 5p | No chat support |

Revolut – Best for Processing Fees

The Revolut Reader is an innovative card machine that brings affordability and efficiency to small business owners. Marking itself as a favorable choice, it offers market-leading transaction fees as low as 0.8% + £0.02 for in-person payments. Its compatibility with contactless payments means that accepting contactless cards and digital wallets like Apple Pay is a breeze. Ensuring security and rapid transaction processing, it minimises the probability of delays, while its user-friendly interface allows for smooth operations with minimal errors.

Moreover, to align with the fluid business operations, settling funds quickly is crucial; the Revolut Reader accomplishes this by ensuring funds availability within 24 hours in the Revolut account. Requiring a business account with Revolut, the setup process of the Revolut Reader provides additional functionalities that extend beyond just payment processing, making it a comprehensive tool for modern commerce.

It offers a hassle-free setup, wireless connectivity, and fast access to credit and debit card payments, with funds reaching your bank account as quickly as the next working day or instantly for a fee. The device features a robust battery, delivering 20% more transactions on a single charge than its predecessor, ensuring reliability.

Features

- Accepts chip and PIN cards

- Low Transaction Fees

- High Security Standards

- Integration with Revolut Business Account

- Portable and Durable Design

Overall Rating

Value

Features

Pricing

The Revolut Reader stands out in the market with its economical pricing strategy. The hardware requires a one-time investment of just £49 (+VAT), positioning it as a financially accessible option for small business owners looking to facilitate card payments without incurring a hefty initial expenditure. This pricing is competitive when compared to other card machine offerings, providing small businesses the opportunity to partake in digital payment systems at a reasonable cost.

Pros

- Saves Money: Paying only 0.8% + £0.02 for each sale is great for businesses that want to keep more of their money.

- Get Money Fast: Money from sales shows up in your account in 24 hours, which helps you have cash when you need it.

- Easy for Customers: People can pay the way they like, fast and without touching, which is what many prefer nowadays.

Cons

- Need a Revolut Account: You have to use Revolut for your business banking to use their card reader, which might not work for everyone.

- Think Long-Term Costs: The initial price looks good, but remember to add up how much you’ll pay over time with each sale.

- Other Things to Consider: Before deciding, think about what your business really needs. Does this card reader do everything you want? Will it work well with how you run your business?

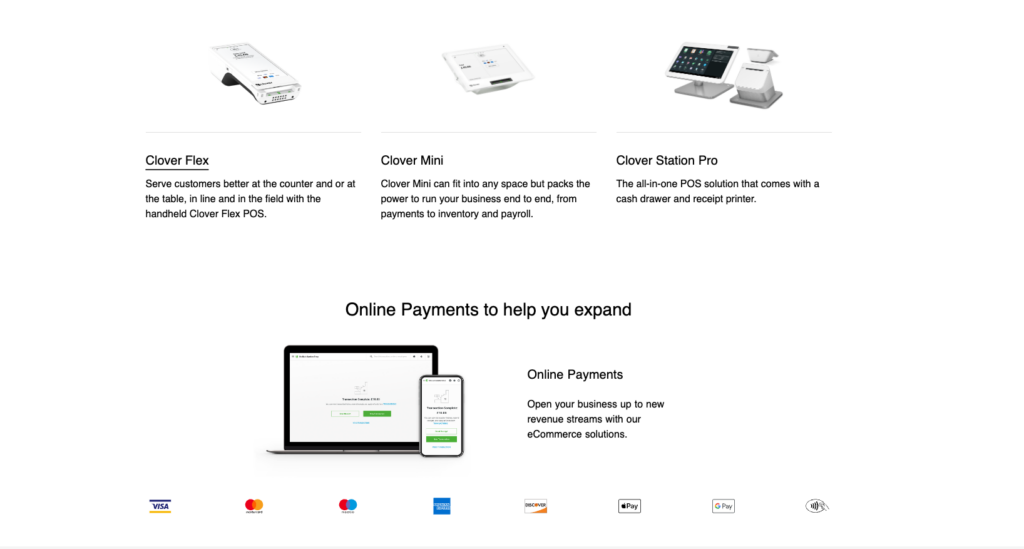

Clover – Best for Retail Stores

Clover stands out in the landscape of card payment solutions by offering a suite of features tailored to the needs of small businesses. Recognised for its multifunctionality, Clover’s card machines integrate critical functions such as sales tracking, employee management, and inventory management, creating an all-in-one system that streamlines operations.

Clover has made a name for itself in the card payment solutions arena by providing a comprehensive ecosystem that caters specifically to the needs of small businesses. It’s not just a payment processing platform; Clover offers an integrated suite of tools designed to simplify and enhance various aspects of business operations.

Pros

- Comprehensive Solution

- Scalable Plans

- Integrated Ecosystem

Cons

- Monthly Costs

- Need for Paid Plans

- Consideration of ROI

Features

- All-in-One System

- Sales Tracking

- Customisable Solutions

- Robust Security

- Ease of Use

Pricing

Clover’s competitive pricing strategy includes a variety of options to fit different business needs and budgets. Hardware options accommodate diverse demands, with the portable PDQ machine Flex leading the way in offering high functionality and portability.

Overall Rating

Value

Features

Zettle Reader – Beset for Mobile Businesses

The Zettle Reader 2 stands as a powerful tool for small businesses, focused on efficiency and simplicity. It ensures compatibility with a wide array of payment cards, including Diners Club and American Express, besides standard Visa and Mastercard, facilitating a smooth transaction process for its users. With a transaction fee fixed at 1.75%, businesses can anticipate their costs without any surprises. The security measures of the Zettle Reader 2 include robust encryption to maintain customer data safety, while the user-friendly interface minimises the risk of manual errors during the checkout process. It offers diverse connectivity options like Bluetooth and integration with mobile apps, which means businesses can process payments anywhere with ease. Additionally, this petite powerhouse enables sales analytics, inventory management, and even staff hours’ tracking through the Zettle app, simplifying business operations on-the-go.

Pros

- Affordable

- Easy setup

- No monthly fees

- Transparent costs

- Ideal for low volumes

Cons

- Costly for high volumes

- No volume discounts

- Fixed pricing model

Features

- Transparent Pricing

- Accepts Chip & PIN, contactless (NFC)

- Ease of Use

- Real-Time Reporting

- Portability

Pricing

| Product | Cost for First Device | Cost for Additional Devices | Monthly Fees | Ideal For |

|---|---|---|---|---|

| Zettle Reader 2 | £29 + VAT | £59 + VAT | None | Small businesses or sole traders |

Overall Rating

Value

Features

Barclaycard Reader – Best for Fast Settlements

The Barclaycard Reader, known as Barclaycard Anywhere, presents a competitive and flexible option for businesses eager to simplify their payment systems. Derived from the trusted financial establishment, Barclays Bank, this reader underscores a commitment to economical transaction fees and diversity in accepted payment methods.

Barclaycard Anywhere extends numerous features designed to enhance the card payment experience for both business owners and customers. Notably, this portable card machine accepts a variety of payment options, such as contactless payments, Mastercard, Visa, Apple Pay, and Google Pay. The integration of these payment methods meets the growing customer demand for swift and convenient payment processes.

The Barclaycard Anywhere card reader is offered at an approachable price point of £29 + VAT, aligning with industry standards set by companies like SumUp. However, unlike some lower-priced competitors such as Square or Zettle, Barclaycard presents itself as a middle-ground option in terms of upfront cost. Where Barclaycard Anywhere stands out is in its transaction fees. With a rate of 1.6% per transaction, it asserts itself as an economical choice over the long term, particularly for those with moderate to high transaction volumes.

Features

- Accepts various payment options: contactless, Mastercard, Visa, Apple Pay, Google Pay

- Free app usage

- Digital receipts via email

- Real-time transaction data

- Transaction data exportable to spreadsheets

| Item | Price | Notes |

|---|---|---|

| Card Reader | £29 + VAT | One-time purchase |

| Transaction Fee | 1.6% | Per transaction |

Pros

- Accepts various payment options: contactless, Mastercard, Visa, Apple Pay, Google Pay

- Free app usage

- Digital receipts via email

- Real-time transaction data

- Transaction data exportable to spreadsheets

Cons

- Low transaction fees

- Wide range of payment options

- Trusted brand

- Useful for moderate to high volumes

Overall Rating

Value

Features

Square – Easiest to USE

Founded by social media pioneer Jack Dorsey, Square has transformed the way small businesses process transactions, with over £84 billion processed annually. This top-tier mobile credit card machine and reader provider is renowned for its simplicity and inclusivity, not requiring credit checks for new account holders—thereby extending access to a range of enterprises that might otherwise find it difficult to kickstart card payments.

Beyond these core functionalities, Square’s ecosystem supports team and inventory management tools, which are crucial for businesses to manage their resources more efficiently. Moreover, the expanded range of features includes enhanced reporting for an in-depth insight into the financial aspects of the business, order management options, and the ability to handle multi-customer transactions for a streamlined checkout experience.

Remaining transparent and competitive in its pricing, Square offers the Square Reader at a very approachable price of £19 + VAT. This no-frills pricing policy extends to its transparent transaction rates with a consistent 1.75% per transaction and no hidden monthly costs or binding contractual agreements.

Square’s ecosystem is also populated with additional hardware tailored to varying business scales. The Square Terminal, at £149 + VAT, caters to businesses needing a more robust portable payment solution, while the Stand, priced at £99 + VAT, secures the tablet for a fixed point-of-sale setting.

Moreover, for every UK card transaction, Square charges a fixed rate of 1.4% plus a 25p fee, and for non-UK card transactions 2.5% plus a 25p fee. Keyed-in transactions are a flat 2.5%. This clear and structured pricing system is part of their commitment to transparency and value.

Pros

- Economical initial cost

- Fixed transaction rates for easy budgeting

- No contracts or credit checks

- Scalable hardware options

- Rich feature set

Cons

- Fixed rates costly for high volumes

- Could overwhelm very small businesses

- No volume discounts

Features

- Affordable Pricing: £19 + VAT for the Square Reader.

- Transparent Fees: 1.75% per transaction; 1.4% + 25p for UK cards, 2.5% + 25p for non-UK cards.

- No Hidden Costs: No monthly fees or binding contracts.

- Variety of Hardware: Options like the Square Terminal (£149 + VAT) and Stand (£99 + VAT) cater to different business needs.

- Comprehensive Ecosystem: Inventory and staff management features included.

Pricing

| Item | Price | Transaction Fee | Notes |

|---|---|---|---|

| Square Reader | £19 + VAT | 1.75% | – |

| Square Terminal | £149 + VAT | UK: 1.4% + 25p Non-UK: 2.5% + 25p | Portable payment solution |

| Square Stand | £99 + VAT | Keyed-in: 2.5% | Tablet POS system |

| Transaction Fee | – | UK cards: 1.4% + 25p Non-UK cards: 2.5% + 25p Keyed-in transactions: 2.5% | – |

Overall Rating

Value

Features

How do credit card machines work?

Credit card machines, also known as Point of Sale (POS) terminals, are essential tools for modern business transactions. They work by reading the information from a debit or credit card’s magnetic stripe or chip. Once a card is swiped, tapped, or inserted, the machine communicates with the issuer to check the card’s validity and ensure sufficient funds are available. This process includes fraud detection algorithms to secure the transaction.

The customer either enters their Personal Identification Number (PIN) or provides a signature for transactions that require additional authentication. To complete this process, card machines connect to banking networks using various methods such as Wi-Fi, Bluetooth, Ethernet, or mobile networks. This ensures the transaction information reaches the acquiring bank, the card network, and ultimately, the cardholder’s issuing bank for approval. Once confirmed, the transaction is completed, and a receipt is printed for the customer’s record.

Card machines have simplified the payment process, allowing businesses to accept a wide range of card types efficiently and securely, including contactless payments, ensuring an enhanced customer experience.

| Connection Type | Use Case |

|---|---|

| Wi-Fi | In-store transactions |

| Bluetooth | Portable card readers |

| Ethernet | Countertop card machines |

| Mobile Network | On-the-go sales |

How to choose the best credit card machine

Choosing the best card machine for your small business involves understanding your sales process, customer interactions, and the physical layout of your establishment. Start by assessing whether a countertop, portable, or mobile unit fits your business operations. For stationary sales points such as checkouts in retail stores, countertop terminals offer reliability with consistent connectivity. Portable card machines provide flexibility within the premises, perfect for bustling restaurants or cafes. Meanwhile, mobile card machines cater to businesses that require mobility, such as market vendors or delivery services, using cellular networks to process payments virtually anywhere.

Contactless capabilities are indispensable for businesses processing a high volume of transactions, maximising customer throughput and convenience. With the prevalence of smartphone payment technologies, such as Apple Pay and Google Pay, it’s beneficial to choose a machine that supports a wide spectrum of contactless options.

For businesses that process transactions remotely, considering a virtual terminal could be key. This enables you to accept payments over the phone or via email, broadening your serviceable market and providing flexibility to your customers.

Factor in the costs associated with each type of machine. Look beyond the upfront purchase or rental cost to consider transaction fees, monthly service charges, and any additional costs for accessories like cash drawers or receipt printers. A transparent pricing model with a clear breakdown of all potential charges will aid in your decision-making process, ensuring you choose a card machine that aligns with your budget and business needs.

Types of credit card machines

When exploring the options available, you’ll encounter three primary types of credit card machines designed for various business environments:

Countertop Card Machines: These devices require a stable connection, typically through an Ethernet cable, making them ideal for fixed payment locations like grocery stores or boutiques.

Portable Card Machines: These machines operate on battery power and connect via Wi-Fi. They are optimal for businesses that require the flexibility to move the payment point, such as taking payment at tableside in a restaurant.

Mobile Card Machines: These units utilise mobile networks, enabling payments where Wi-Fi or wired connectivity is unavailable. This type is geared towards businesses without a fixed location, those attending events, tradespeople, and mobile services.

Each type has its unique costs and complexities. Hence, delineating the particular needs of your business will guide you to the suitable choice. Consider creating a comparison table of the features and costs associated with each card machine type to aid your decision.

Essential equipment features

When selecting a card machine, it’s imperative to ensure compatibility with the predominant card types used by your customers, such as Visa, MasterCard, American Express, and Discover. Some machines also accept payments from alternative providers like Diners Club.

Security is paramount, so look for machines with robust encryption and tokenisation offerings to safeguard customer data and comply with standards like PCI DSS (Payment Card Industry Data Security Standard). Fast and reliable transaction processing is non-negotiable; delays can deter customers and impact sales.

Given the varied technical skills of personnel, card machines must possess user-friendly interfaces. Simple, clear instructions on the machine assist in minimising transaction errors and streamlining the checkout process. Equally important are connectivity options – Wi-Fi, Bluetooth, Ethernet, and mobile networks should be stable and fast to accommodate a seamless payment experience.

Essential software features

Modern credit card machines come equipped with advanced software features that enhance the security and versatility of your transactions. Encryption and security protocols like P2PE (point-to-point encryption) keep customer information secure and transactions safe from fraud. The software interface should be intuitive, allowing for quick training of staff and daily operation.

Connectivity stability transcends to the software aspect with features that ensure continuous operation even during network disruptions. Integration capabilities with existing POS or EPOS systems enable centralised monitoring and accounting of all sales, which is particularly beneficial for inventory management and reconciling accounts.

Additionally, the included software should support CNP (Cardholder Not Present) transactions, making it possible to process payments over the phone or through an online portal, thus expanding your business’s reach beyond face-to-face interactions.

Frequently Asked Questions

What are credit card machines and how do they work?

Credit card machines, also known as POS (Point of Sale) terminals, facilitate transactions by reading a debit or credit card’s magnetic stripe, chip, or NFC (contactless) signal. They connect to banking networks to verify funds and complete transactions, supporting a variety of payment methods including contactless, chip and PIN, and mobile payments.

How do I choose the best credit card machine for my business?

Select a card machine based on your business type, transaction volume, and customer interaction style. Consider whether you need a countertop, portable, or mobile unit, and evaluate the transaction fees, monthly service charges, and support for contactless payments and various card types.

What types of credit card machines are available?

Countertop Card Machines: Best for fixed payment locations with wired connectivity.

Portable Card Machines: Ideal for flexible payment locations within a premise, operating on battery and connecting via Wi-Fi.

Mobile Card Machines: Suitable for businesses without fixed locations, using mobile networks to process payments.

What should I look for in a card machine?

Key considerations include compatibility with various payment methods, security standards compliance (such as PCI DSS), ease of use, reliability, and connectivity options. Also, assess if the machine supports all the card types your customers commonly use.

What software features are important in a credit card machine?

Look for software that offers robust encryption, an intuitive interface, reliable connectivity, integration with your existing systems, and support for Cardholder Not Present transactions. These features enhance security, operational efficiency, and the versatility of payment acceptance.

How are transaction fees structured for credit card machines?

Transaction fees can be a fixed rate per transaction, a percentage of the transaction amount, or a combination of both. Fees vary based on the card type (e.g., credit, debit, foreign cards) and the payment method (e.g., contactless, chip and PIN).

Can credit card machines work without an internet connection?

Some credit card machines can process payments offline by storing transaction data to be transmitted when a connection is available. However, real-time processing requires an internet or mobile network connection.

What are the benefits of using a credit card machine?

Credit card machines offer faster, more secure transactions, improved customer satisfaction by accepting various payment methods, and detailed transaction records for better financial management.

Are there any downsides to using credit card machines?

Considerations include the upfront cost of the machine, ongoing transaction fees, potential technical issues, and the need for staff training. High-volume businesses should also evaluate if the fixed transaction rate models are cost-effective.

Final Words

As we’ve explored the features, pricing, and pros and cons of some of the leading card machines like Revolut Reader, Clover, Zettle Reader 2, and Barclaycard Anywhere, it’s clear that the perfect choice varies depending on individual business requirements. The decision to invest in a particular card machine should be informed by a thorough understanding of your business’s transaction volumes, customer payment preferences, and operational needs. With the information provided, we hope to have illuminated the path towards choosing a card machine that not only meets your current demands but also scales with your business growth.

We’re eager to hear your thoughts and experiences! Have you used any of these card machines, or is there another model you’d recommend? What factors influenced your choice, and how has it impacted your business operations? Share your insights and questions in the comments below, and let’s continue the conversation to help businesses make informed decisions in their quest for the perfect payment processing partner.