In an age where cashless transactions have surged to the forefront of commerce, Square Terminal emerges as a beacon for businesses navigating the digital payment landscape. Square, synonymous with innovative financial tools, has crafted another gem tailored for modern merchants. It beckons with the promise of simplicity and efficiency in payment processing.

Delving into what Square Terminal offers is akin to unravelling a bundle of commercial benefits. From its sleek design accommodating versatility in payments to the nitty-gritty of fees and feature sets, understanding these facets is crucial for businesses considering an upgrade. Exploring its capabilities could be the turning point for an enterprise striving for transactional excellence.

Stand by as we embark on a comprehensive Square Terminal review. Whether you are an entrepreneur pondering its value, a business poised to enhance customer payment experiences, or simply curious about the technology, this guide paves the way through the ins and outs of Square Terminal’s system, its optimal business matches, and how it squares up against the ubiquitous Square Reader.

What is Square Terminal?

Square Terminal is an all-in-one card machine, renowned for its portability and robust battery life that can endure an entire business day. This makes it the perfect companion for users who need to process payments seamlessly, no matter where they are within their establishment, be it at the checkout counter or tableside in restaurants. Its design focuses on simplicity and efficiency, allowing for hassle-free setup that eliminates the need for any bank interventions—a real boon for both merchants and their customers.

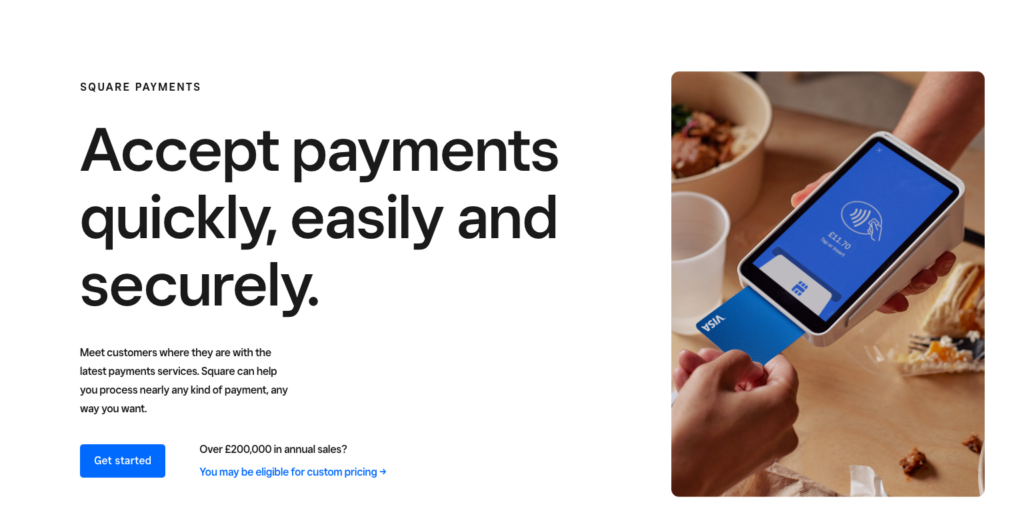

What sets Square Terminal apart is its ability to accept a range of payment types, including all major credit and debit cards, PIN cards, and contactless payments, such as those made with contactless cards or mobile wallets like Apple Pay and Google Pay. Transactions are processed at a flat fee, eliminating any uncertainty about hidden charges. Moreover, the lack of long-term commitments or contracts gives businesses the flexibility they demand.

Integrated within the Square Terminal is the free Square Point of Sale (Sale) software, which facilitates quick, precise sales entries and expedited customer checkouts. The device also boasts advanced features like an offline mode, ensuring payment processing continues uninterrupted even in the absence of Wi-Fi. To top it off, Square provides around-the-clock fraud prevention and dedicated phone support, reinforcing security and service reliability.

Fees and payouts

When it comes to financials, the Square Terminal adopts a transparent and straightforward pricing strategy. For the terminal hardware itself, merchants have the option to pay a one-time fee or choose interest-free monthly instalments. In addition to hardware costs, businesses are charged a flat rate for each transaction processed, covering debit and credit card processing without extra payout fees or hidden surcharges.

No minimum sales volume is mandated, meaning users from small startups to bustling enterprises can benefit from the same fair cost structure. The absence of long-term contracts and transaction fees ensures that businesses only pay for what they use, when they use it. Square’s promise of next-business-day payouts not only enhances cash flow management for businesses but also adds a layer of financial predictability essential for operating successfully.

Features

Square Terminal emerges as a market favourite due to its impressive array of features designed with business efficiency in mind. At the core of its design is a powerful battery that ensures the machine remains operational all day, adding mobility and convenience to payment processing. The unit requires no technical expertise to set up, bypassing traditional banking setups and coming into operation in mere minutes.

The Square Terminal boasts a wealth of features designed to streamline business operations and enhance the customer payment experience:

All-Day Battery Life: A powerful battery ensures the Square Terminal remains operational all day, providing mobility and convenience to payment processing without constant recharging.

Ease of Setup: Requires no technical expertise for setup, allowing businesses to bypass traditional, cumbersome banking setups and become operational in minutes.

Universal Payment Acceptance: Accepts all major cards, including contactless and PIN payments, processed at a transparent, single flat rate, simplifying financial transactions for businesses.

Round-the-Clock Support: Offers 24/7 phone support to promptly address any operational issues, ensuring continuous business operations without interruption.

Robust Security Measures: Includes formidable protections against card fraud, such as next-business-day hardware replacement and vigilant fraud support, safeguarding business operations and customer transactions.

Flexible Receipt Options: Supports digital receipts through SMS or email, as well as physical receipts via compatible thermal printers, catering to customer preferences and industry standards.

Comprehensive Business Tools: The integrated software offers features essential for modern businesses, including item management, sales tracking, and handling payment disputes, tailored to meet a wide range of business needs.

Portable and User-friendly Design: Its design emphasises ease of use and portability, allowing businesses to efficiently manage payments whether at the counter, at the table, or on the go.

Transparent Pricing: With a single flat rate for all transactions, businesses can easily manage their finances without worrying about variable processing fees.

Free Sale Software Integration: Comes packaged with free Sale software, eliminating the need for separate devices or additional software, streamlining sales operations with a comprehensive system that supports smooth checkout screens and various receipt options.

Who is Square best for?

Square Terminal is a versatile tool that caters to a wide array of businesses seeking a comprehensive payment solution. It is particularly advantageous for operations like dry cleaners and dental offices, where managing a variety of services, transactions, and customer interactions quickly and efficiently is paramount. The all-in-one nature of Square Terminal enables these businesses to handle everything from item management to payment processing and receipt printing, all within a single device.

In environments where employees are regularly on the go, such as in the bustling setting of Yamabahce, a popular restaurant, Square Terminal excels by offering the flexibility to take orders and process payments anywhere on the premises. The versatility of this device comes to the fore in food establishments as well. Customised receipt functionalities and the ability to print kitchen order tickets streamline the management of pickup and delivery orders that are paid for online, consequently enhancing order fulfillment efficiency.

Moreover, Square Terminal seamlessly integrates with various devices. The transition to using Square Terminal is smooth for businesses employing iPads, iPhones, or Android devices, thanks to compatibility with Square’s POS apps. This seamless integration is a boon for businesses that require agility in table-side payments, inventory management, and other essential operational tasks. The built-in receipt printer further aids in delivering an improved customer experience by generating detailed receipts and ensuring owners stay on top of software updates and transactions with minimal fuss.

Pricing and payment options for Square Terminal

Square Terminal boasts a straightforward pricing model, charging a competitive 1.75% rate for every in-person transaction, with the convenience of next working day fund availability. Businesses that require immediate access to their funds can take advantage of Instant Transfers at a minimal transaction fee of just 1%.

Currently, Square Terminal is available at an enticing limited offer price of just £149 + VAT. To make this investment more accessible, Square offers interest-free instalment plans spanning 3, 6, or 12 months, easing the financial burden on businesses and making this powerful tool more attainable for many users. This transparent and flat-rate processing fee structure ensures businesses are not confronted with unexpected costs, making budgeting and financial forecasting more reliable.

Square Terminal’s transaction costs and fees

Square Terminal maintains a simplified fee structure, with a fixed rate of 1.75% levied on all chip, contactless, and swipe card payments. This applies consistently across different card brands and countries of origin. For transactions requiring key-in details or invoicing through the virtual terminal, a fee of 2.5% per transaction is incurred. E-commerce transactions via the online store attract fees of 1.4% + 25p for cards issued in Europe and 2.5% + 25p for non-European cards.

Should businesses need to connect their Square Terminal to additional hardware, a Hub for Square Terminal is available for £39 + VAT. Furthermore, Square Terminal offers the assurance of handling chargebacks without additional costs, holding on to the original transaction fee for smooth financial operations.

Understanding the different payment methods accepted by Square Terminal

Square Terminal is adept at processing a variety of payment methods, adhering to a flat transaction rate of 1.75%. This includes chip and PIN or contactless payments. When connectivity is temporarily lost, offline transactions can still be carried out with chip and PIN, provided the terminal reconnects to the internet within 24 hours to authorise the payment.

For optimal functioning, Square Terminal requires an internet connection via WiFi. There’s also an optional Hub for Square Terminal that allows Ethernet cable connections for businesses with such a requirement. At the time of the transaction, customers can choose their preferred method of receiving receipts, with options ranging across digital and physical formats. It’s important to note that while Square Terminal does rely on internet connectivity for transactions, it operates exclusively on WiFi and broadband connections, not 4G, and is designed to work in harmony with Square’s specialised POS systems like Restaurants, Retail, or Appointments, offering a cohesive and efficient payment solution.

Square Terminal Software

Square Terminal is revolutionising how businesses handle transactions by providing a software solution that simplifies operations and enhances customer service. This all-in-one card machine comes equipped with customisable software. It offers flexibility that allows business owners to modify checkout screens and choose from various receipt options to best align with their brand and customer preferences.

With its powerful software, Square Terminal delivers immediate access to sales data and searchable transaction history, helping merchants to track performance and refine sales strategies effectively. Moreover, with its capability to perform seamless updates over the internet, the terminal ensures businesses are always at the forefront of technology and security.

Starting with Square Terminal is straightforward through an in-depth guide conveniently available on the device. It assists new users in configuring the terminal, managing inventory, and setting up hardware components like receipt printers that use thermal printer paper, ensuring a smooth setup process.

Notably, Square Terminal offers:

- A flexible, customisable software interface

- Real-time sales insights

- Daily automatic software updates

- An easy-to-use setup guide

With Square Terminal, businesses can elevate their transactional experience, ensuring their operations are efficient, secure, and tailored to meet industry requirements.

Square Terminal for Businesses

Square Terminal is an intuitively designed, sleek, and modern card machine that has made it exceptionally easy for businesses to accept payments without the complexity of traditional banking procedures. Its versatility allows for quick setup and immediate use. This compact device liberates small and large businesses from the burdens of hidden fees and long-term agreements, thanks to its transparent, flat-rate transaction fees. Square Terminal stands out for its comprehensive service, offering 24/7 phone support, a one-year warranty, and consistent performance to ensure uninterrupted business operations. With an all-in-one design, it handles payment processing, prints receipts, and even operates offline, making it a robust solution for a wide range of business needs.

Suitable business types for Square Terminal

Square Terminal represents outstanding value, particularly for small retailers who seek to minimise ongoing costs and avoid lengthy contracts. Its reliable 24/7 phone support, prompt next-business-day hardware replacement if necessary, and rigorous fraud prevention measures make it an ideal choice for businesses that require steadfast support and robust security. The long-lasting battery life of the Terminal is perfect for businesses that need a portable payment system — from market stalls to mobile food vendors. Due to its simplicity and ease of use, Square Terminal is well-suited for businesses that desire a fast, user-friendly setup process, negating the need to involve banks. Its built-in Square Point of Sale app ensures rapid and precise customer checkouts, aligning perfectly with businesses aiming for efficient transaction processing and minimal wait times for customers.

Benefits of using Square Terminal for businesses

The benefits of utilising Square Terminal for businesses are manifold. Not only does it provide a financial advantage through its lack of hidden fees and monthly costs, but it also eschews long-term commitments altogether. This financial clarity is complemented by comprehensive customer support, available around the clock, a reassuring one-year warranty and even a 30-day risk-free return period. Its elegant and intelligent design contributes to a secure and dependable user experience. Additionally, Square Terminal boasts a powerful battery that can last a business day and offers multiple connectivity options, including Wi-Fi and Ethernet, guaranteeing continuous sales opportunities. With its straightforward setup and intuitive operation, businesses can quickly become operational, enabling swift and effective employee training.

Examples of industries that can benefit from Square Terminal

Square Terminal is immensely valuable across various industries. It is particularly useful for cashless restaurants, such as Yamabahce, where staff can efficiently process orders, accept contactless and Chip and PIN payments, and send digital receipts directly to customers at the table. Its elegant design, user-friendliness, continuous support, and trial period without fees align well with the operational requirements of small retail shops. Different sectors, including but not limited to food trucks, pop-up shops, and quick-service restaurants, can leverage the Terminal’s easy setup, rapid transaction handling, and day-long battery life to their advantage. Moreover, the flexibility Square Terminal offers in accepting an array of payment types — from all major cards to contactless methods — along with a personalised checkout experience makes it a versatile tool for enterprises of various scopes and specialities. Its dependable hardware and security features, including proactive fraud prevention, allow businesses to focus on growth while mitigating risks associated with card payments.

Square Terminal’s role in enhancing the customer experience

The customer experience is heightened through Square Terminal’s ability to process all major credit cards and contactless payments, adding layers of convenience and choice for consumers. The Terminal is crafted to be instinctive, minimising the learning curve for both staff and customers, which contributes to a smooth and swift payment process. Square Terminal’s mobility, due to its powerful, all-day battery, allows businesses to meet customers wherever they are, facilitating cordless transactions throughout the location. Furthermore, its integrated point-of-sale software is an asset for quick and accurate sales entries and customer checkouts, which enhances the overall transactional experience. Its streamlined design, dependable operations, and features like Offline Mode, which allows continuous service even in the event of Wi-Fi disruptions, solidify Square Terminal’s position as a tool that significantly enriches customer service environments.

Square Terminal Setup and Support

Businesses across the globe are increasingly embracing Square Terminal for its ease of use, seamless integration, and reliable support system. Square offers around-the-clock support and robust fraud prevention strategies, aiming to ensure that daily transactions proceed smoothly and securely. Even in the chaotic swirl of a business day, the Terminal’s long-lasting battery life and the capability to accept chip, PIN, and mobile wallet payments via Apple Pay and Google Pay keep operations running without a hitch—even in Offline Mode. What’s more, you don’t need to tether Square Terminal to a bank account, which makes setting it up a breeze, free from long-term contracts and unexpected fees.

Setting up Square Terminal for business use

Empowering businesses to initiate quick, wireless connectivity, Square Terminal stands out as the epitome of portable payment processing. Its straightforward setup process doesn’t necessitate detailed training or bank involvement, saving valuable time and resources. With its foundation set on major card and contactless payment acceptance, businesses can enjoy a streamlined fee structure, while the built-in Point of Sale software aids in effortlessly managing their day-to-day transactions. Notably, Square Terminal isn’t just about the convenience of portability and ease of setup; its durability shines through via a potent battery designed to last through intensive business hours, eliminating the dependence on additional hardware or software.

To get started with Square Terminal, new users can:

- Create a Square account online.

- Follow the step-by-step Setup Guide, which is available in-app or online.

- Pair the device with a compatible iOS device using a unique device code.

- Manage items and set up taxes in the intuitive Square Sale app.

- Start accepting payments without delay, thanks to the Terminal’s prompt setup process.

Square Terminal support and customer service options

Square Terminal users have immediate access to a comprehensive support system, available 24/7 via phone or email. The dedicated Support Centre is a treasure trove of useful articles, tips, and video tutorials to assist with any queries. Beyond the extensive online resources, Square Terminal also comes with a reassuring two-year warranty, cementing confidence in its durability and quality. This standout after-sale service ensures that merchants have the support they need, any time of day, without disruptions to their business flow. With Square, customers also receive proactive fraud prevention and consistent phone support, guaranteeing a secure and reliable experience throughout their payment processing activities.

Square Terminal warranty and terms

Underlining its commitment to customer satisfaction and product assurance, Square Terminal is provided with a two-year limited warranty, safeguarding businesses against potential technical troubles. This warranty applies from the date of the original purchase, offering a considerable period of protection. For those wary of upfront expenses, Square Terminal can be acquired for an upfront cost of £149 + VAT, or chosen via an accessible monthly payment plan of £25 + VAT over six months. Additionally, the Terminal’s design accommodates a range of accessories, enhancing its capability by connecting to accessories such as receipt printers and barcode scanners, thereby meeting diverse industry requirements and expanding its functionalities.

Square Terminal vs Square Reader

When it comes to processing card payments, Square offers two notable options: Square Terminal and Square Reader. Square Terminal is an all-in-one machine that requires no extra devices, directly connecting to the internet for swift contactless and PIN card payments. In contrast, the compact Square Reader leverages Bluetooth to pair with a mobile device which then handles the POS functionalities.

| Feature | Square Terminal | Square Reader |

|---|---|---|

| Product Name | Square Terminal | Square Reader |

| Price | £149 + VAT | £19 + VAT |

| Size (L x W x H) mm | 142.2 x 86.4 x 63.5 | 66 x 66 x 10 |

| Weight (g) | 417 | 56 |

| Connections | WiFi, Ethernet via Hub (extra cost) | Bluetooth to mobile device with network connection |

| Works without phone/tablet | Yes | No |

| Built-in receipt printer | Yes | No |

One key advantage of the Square Terminal is its built-in capabilities for printing detailed receipts, an important business day necessity, and handling swipe card transactions. This contrasts with the more minimalist Square Reader, which depends on a separate device such as a smartphone or tablet for these tasks.

Security is also a consideration; the Square Terminal allows for direct PIN entry, which can alleviate customer concerns about entering sensitive information on a mobile screen. Moreover, for those mobile transactions, the Square Reader utilises the connected device’s internet to process payments, while the Terminal requires its own connection to manage contactless and card sales.

In summary, Square Terminal serves as a stand-alone payment solution with enhanced functionality, whereas Square Reader is designed for on-the-go use with a mobile device.

| Feature | Square Terminal | Square Reader |

|---|---|---|

| Connectivity | Direct internet connection | Requires mobile device with Bluetooth |

| Receipt Printing | Built-in printer | Dependent on mobile device |

| Swipe Card Function | Yes | No |

| PIN Entry | Direct on Terminal | Dependent on mobile device |

| Independent Operation | Yes | No; requires a mobile device |

| Use Case | Full-service, stand-alone processing | On-the-go, paired with a mobile device |

Frequently Asked Questions

What is Square Terminal?

Square Terminal is an all-in-one card machine known for its portability and robust battery life, capable of lasting an entire business day. It simplifies payment processing by allowing for seamless transactions anywhere within a business setup. Its design is focused on efficiency and simplicity, accepting a wide range of payment types without the need for complex setups.

Who is Square best for?

Square Terminal serves a wide variety of businesses looking for an integrated payment solution. It is especially beneficial for operations requiring versatility in payment methods, such as restaurants, retail shops, and service providers. Its all-in-one nature supports diverse business activities, from managing transactions to printing receipts on the go.

What are the pricing and payment options for Square Terminal?

Square Terminal offers transparent pricing with a competitive rate for in-person transactions and the option for next-day fund availability. It’s priced at £149 + VAT, with interest-free installment plans available to spread the cost over time. This clear, flat-rate fee structure helps businesses manage their budgets effectively.

How does Square Terminal handle transaction costs and fees?

Transaction fees are set at a fixed rate, ensuring straightforward financial management for businesses. This includes a consistent fee across different card types and payment methods, with no hidden costs or long-term contracts, providing a flexible and predictable pricing model.

What payment methods are accepted by Square Terminal?

Square Terminal accepts all major credit and debit cards, PIN cards, and contactless payments, including mobile wallets like Apple Pay and Google Pay. It offers a flat transaction fee for a wide range of payment options, ensuring businesses can cater to all customer preferences.

What features does Square Terminal offer?

Key features include all-day battery life, ease of setup without technical expertise, universal payment acceptance, 24/7 support, and robust security measures. It also supports flexible receipt options and integrates with free Sale software, making it a comprehensive tool for business operations.

How does Square Terminal compare to Square Reader?

While both are designed to process card payments, Square Terminal is a standalone device with built-in internet connectivity, receipt printing, and the ability to handle swipe card transactions independently. In contrast, Square Reader is more compact and requires a mobile device to manage POS functionalities, making it suitable for mobile transactions.

What support and setup options are available for Square Terminal?

Square Terminal offers extensive support, including 24/7 phone assistance and a comprehensive online Support Centre. The setup process is straightforward, requiring no bank involvement, and includes a detailed guide for quick configuration. It’s designed for ease of use, enabling businesses to become operational rapidly.

What are the benefits of using Square Terminal for businesses?

Benefits include transparent pricing with no hidden fees, comprehensive 24/7 support, a one-year warranty, and a range of connectivity options. Its design focuses on portability and ease of use, making it suitable for a wide range of business types and sizes.

How does Square Terminal enhance the customer experience?

It facilitates swift and convenient payment processing through multiple methods, improving transaction speed and reducing wait times. The terminal’s portability allows for payments to be taken directly to customers, enhancing the overall service experience.

Final Words

Square Terminal represents a significant advancement in payment processing technology, offering a blend of convenience, efficiency, and flexibility that caters to a wide range of business needs. Its all-in-one design, robust feature set, and straightforward pricing model make it a compelling choice for businesses of all sizes, from small startups to established enterprises. By simplifying the transaction process, enhancing customer service, and providing reliable support, Square Terminal helps businesses focus on what they do best: serving their customers and growing their operations.

Whether you’re looking to upgrade your payment system, streamline your sales process, or provide your customers with more payment options, Square Terminal offers a solution that combines modern technology with ease of use. Its commitment to security, coupled with comprehensive support and a user-friendly interface, ensures that businesses can operate with confidence and peace of mind.

In an evolving digital landscape, choosing the right payment processing solution is crucial. Square Terminal not only meets this need but also anticipates the future challenges of commerce, making it an invaluable tool for businesses aiming to thrive in today’s competitive market.