In an age where plastic trumps paper, card payment machines have become the lifeblood of commerce. They bridge the gap between customers’ bank accounts and a business’s bottom line, transforming taps and swipes into transactions. This explosion in digital payment facilitates a vital question: which card payment machine provider best suits your business needs?

Delve into the realm of card payment machine providers, where the promise of seamless transactions hangs on technology and terms. From brick-and-mortar shops to bustling food trucks, each provider offers a unique concoction of features, fees, and customer service to cater to the diverse landscape of traders. Embrace the journey through the panoramic offering of Takepaymentsplus, Zettle, Revolut, Square, and SumUp, as we dissect their features, pricing, and the inevitable trade-offs that come with each.

Welcome to the guide that navigates the fine print and big promises of card payment machine providers, helping you to arm your business with the ideal partner in payment processing. Whether you’re looking for unbeatable support, value for money, minuscule transaction fees, rapid payouts, or a companion for your itinerant enterprise, this article embarks on the quest to demystify your options.

|  |  |  |  |  |

Card Machine | Тakepaymentsplus | Zettle Reader | Revolut | Square | SumUp Air Reader |

Hardware | £25 (excl. VAT) | From £59 + VAT | £49 + VAT | £22.80 (incl. VAT) | £39 + VAT |

Transaction fees | 0.8% + £0.02 | 1.75% | £0.8% + £0.2 | 1.75% for card transactions | £20 |

Card Machine Type | Mobile/Portable | Mobile | Mobile | Mobile | Mobile |

Customer Support | 8am – 7pm Mon-Fri 8am – 6pm Sat 9am – 5pm Sun & Bank Holidays | 9am-5pm Mon-Fri | Only one card reader option | 9am-5pm Mon-Fri | 8am and 7pm Mon-Fri 7am and 5pm Sat-Sun |

Тakepaymentsplus – Best for help and support

Takepaymentsplus has emerged as a beacon for businesses that demand not only seamless card transactions but also comprehensive support. The PAX A920, a robust device boasted by takepaymentsplus, is more than just a card payment machine. It excels in offering advanced on-screen POS features, including a versatile product library tailored to support the intricate needs of modern businesses.

What sets the PAX A920 apart is its sophisticated software functionality, which extends far beyond the realm of basic transaction processing. This includes detailed inventory management, a boon for businesses eager to streamline their operations. With such features, businesses can enjoy an elevated level of support and functionality that simplifies complex transactional and support necessities.

Adopting takepaymentsplus means equipping one’s business with a dynamic tool that is particularly adept at handling various on-screen tasks. This reflects in the choice of many business owners who prioritise a combination of responsive help and support alongside a comprehensive set of POS features that are integrated within the impressive capabilities of the PAX A920 device.

Features

- Advanced POS Features

- Detailed Inventory Management

- Comprehensive Business Support

- Sophisticated Software Functionality

- Dynamic Tool for Various Tasks

Pricing

| Card machine | Transaction fee | Monthly fee |

|---|---|---|

| £25/month | Bespoke | From £20 |

Overall Rating

Value

Features

Pros

- Integrated POS System

- Inventory Management

- Comprehensive Support

- Sophisticated Software

- Versatile Functionality

Cons

- Complexity for Some Users

- Cost:

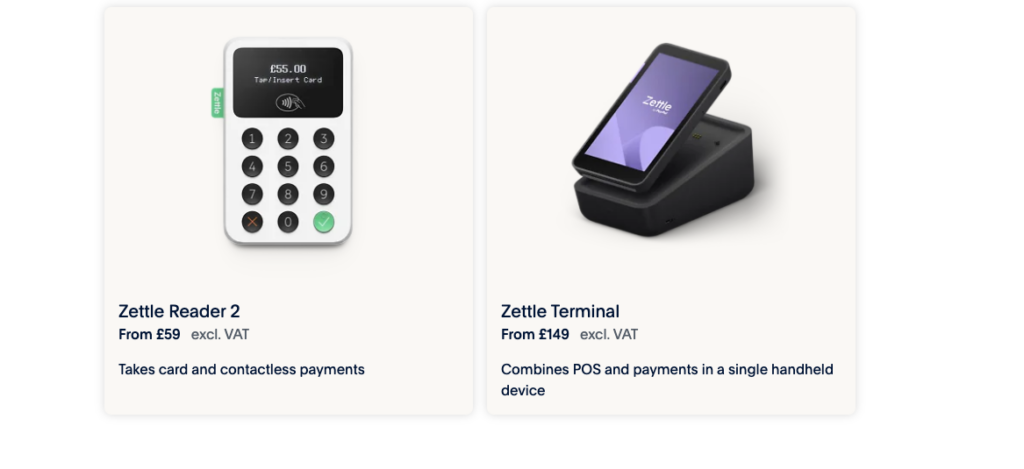

Zettle Card Reader 2 – Best Value for Money

Economically savvy business owners know that every penny counts, and when it comes to card payment machines, the Zettle Card Reader 2 emerges as the go-to choice for those looking for best value for money.

Priced accessibly at £29 for the first unit and £59 for any additional ones, this card reader is a magnet for budget-conscious entrepreneurs across the UK.

Zettle by PayPal differentiates itself through competitive pricing and offering a clear-cut, flat transaction fee of 1.75% for various card payments, including those made with American Express. This transparent pricing structure is a testament to Zettle’s commitment to providing cost-effective solutions without hidden costs.

Features

- Long Battery Life

- Quick Setup

- Versatile Payment Acceptance

- Online Invoicing Capability

- Integration with PayPal

Pricing

| Item | Price for First Purchase | Price for Subsequent Purchases |

|---|---|---|

| Zettle Card Reader 2 | £59 | £59 per unit |

Overall Rating

Value

Features

Pros

- Affordability

- Scalability

- Flexibility in Payments

- Ease of Setup

- Integration Capabilities

Cons

- Cost of Expansion

- Battery Life

- Payment Processing Fees

Revolut Card Machine – Best for Cheap Transaction Fees

Revolut Reader, designed to cater to modern payment needs. The device is not just sleek; it’s also highly functional, delivering instant and secure transactions whether they come via chip & pin, contactless, or mobile options such as Apple Pay, Google Pay, and Samsung Pay. This adaptability to various payment methods means that businesses can cater to a wider range of customers without any hassle.

As efficiency becomes more critical in the fast-paced retail environment, the Revolut Reader stands out with its ability to process payments in under 5 seconds. Speed is a significant factor for customer satisfaction and can help boost the transaction flow during peak business hours.

While it does offer robust payment processing capabilities, a notable shortfall of the Revolut Reader is that it currently does not accept American Express cards, which might limit transactions with customers preferring this payment method. In terms of technical integration, the Revolut Reader pairs seamlessly with the Revolut Business app, offering real-time transaction tracking.

Even though some initial challenges with software bugs and customer support responsiveness have been noted, Revolut is recognised for its commitment to continuous product improvement.

Features

- Accepts chip and PIN cards.

- Supports contactless card payments.

- Compatible with Apple Pay and Google Pay.

- Offers data security and fraud prevention.

- Extended battery life for more transactions.

Pricing

| Card machine | Transaction fee | Monthly fee |

|---|---|---|

| From £49 (excl. VAT) | 0.8%-2.6% + 2p | None |

Overall Rating

Value

Features

Pros

- Low Transaction Fees

- Seamless Integration

- Rapid Fund Settlement

- User-Friendly

- Versatile Payment Acceptance

Cons

- Requires Revolut Business Account

- Limited Hardware Options

- Dependence on Digital Infrastructure

Square Reader – Best for quick payouts

In the bustling marketplace of card payment solutions, the Square Reader stands out, particularly revered for its swift payment processing and ease of fund access. Known as the most compact and portable option available, this card machine is a favourite for on-the-go businesses and small enterprises eager to accept payments without the bulk and complexity of traditional card machines.

Square sets itself apart by offering an array of specialised Point of Sale apps tailored to various business sectors, including retail, hospitality, and services. This enables businesses to cultivate customer loyalty programs, manage detailed product inventories, and oversee employee schedules within the same ecosystem. For enterprises preferring a standalone option, the Square Terminal caters to this need with WiFi connectivity and integrated sale functions.

Features

- Accepts chip and PIN cards.

- Supports contactless card payments.

- Compatible with Apple Pay and Google Pay.

- Offers data security and fraud prevention.

- Extended battery life for more transactions.

Overall Rating

Value

Features

SumUp Air – Best for businesses on the go

For busy entrepreneurs and tradespeople who require a mobile payment solution that keeps pace with their on-the-go lifestyle, the SumUp Air card payment machine emerges as a top contender. Its intuitive design and robust battery life make it an essential tool for any mobile business operation.

SumUp Air supports an array of card types, including contactless payments like NFC-enabled debit and credit cards, digital wallets, and contactless cards such as Visa, MasterCard, American Express, and Diners Club. Furthermore, it assists vendors in managing their sales with a built-in product catalogue software, which is especially handy for inventory tracking across various venues.

Pros

- Cost-Effectiveness

- Ease of Use

- Portability

- Versatile Payment Acceptance

- Long Battery Life

Cons

- Internet Dependency

- Limited Advanced Features

- Fixed Transaction Fees

- Device Compatibility

Features

- Broad Payment Compatibility

- Portable and Lightweight Design

- Long Battery Life

- No Monthly Fees

- Simple Pricing Structure

- Quick and Easy Setup

Pricing

| Item | SumUp Air | Square | Zettle |

|---|---|---|---|

| Purchase Price | £39 | £29 + VAT | £22.80 |

| Transaction Fee | 1.69% (or 1.49% with SumUp Business Account) | 1.75% | 1.75% |

| Business Account Benefits | Faster next day transfers | – | – |

| Reporting and Management | Limited (sales, revenue, payouts, transactions) | Advanced (including team and inventory management) | Advanced (including team and inventory management) |

| Weekend Support | Available | Not available | Not available |

| Battery Life | 12 hours | Varies | Varies |

Overall Rating

Value

Features

What is a card payment machine?

A card payment machine, widely recognised as a PDQ or card reader machine, is a pivotal tool for contemporary businesses, facilitating swift and secure card transactions. With Chip and PIN or NFC technology integration, these devices cater to the growing preference for credit and debit card payments, especially through contactless methods.

Typically portable, card payment machines require a stable WiFi or mobile network (3G/4G) to operate, aligning with the dynamic needs of small businesses. Their design and functionality come in a broad spectrum–from mobile card readers that pair with smartphones to multifunctional smart POS terminals with touchscreens.

Safety is paramount; during transactions, card details are encrypted and transmitted through a secure process involving merchant banks, card networks like Visa or MasterCard, and the cardholder’s bank. This system checks the card’s validity, confirms available funds, and employs fraud detection measures.

| Type of Card Machine | Typical Use Case |

|---|---|

| Countertop | Fixed POS |

| Portable | Table service |

| Mobile | On-the-go sales |

| Smart POS | Advanced features |

Overall, these devices have evolved into an indispensable component for efficient and secure payment processing, reflecting the modern landscape where convenience and security are key for both business owners and customers.

Choosing the best card payment machine for you

When selecting the ideal card payment machine for your small business, there are several essential factors to ponder. Business type, annual card turnover, and the need for mobility play pivotal roles in determining the most suitable option.

Prioritise understanding the transaction fees, functionality, service levels, and integration capabilities of various card readers. While payment facilitators offering mobile card readers or portable card machines may have transparent fixed transaction rates, these could be steep compared to traditional payment companies like Worldpay or Takepayments, which may present higher upfront costs but lower transaction charges in the long run.

To ensure you’re making an informed decision, consider the following:

- Transaction Fees: Assess fixed vs. volume-based fees and how they align with your card turnover.

- Functionality & Service: Evaluate whether the machine accepts a wide range of card types (e.g., debit cards, credit cards, Digital Wallets), including contactless cards and American Express, and if it integrates with your existing systems.

- Cost Efficiency: Reflect on not just the machine cost but also the ongoing transaction fees to maximise revenue per payment.

Ultimately, take into account the initial cost, ongoing expenses, and whether monthly contracts or cancellation fees apply, especially if your business experiences seasonal fluctuations. This multifaceted approach will guide you towards the most cost-effective and efficient card payment solution.

Frequently Asked Questions

What is a card payment machine?

A card payment machine, also known as a PDQ or card reader machine, is a device that enables businesses to process credit and debit card transactions. These machines can be portable, requiring WiFi or a mobile network to operate, and are designed to meet the needs of businesses of all sizes. They ensure secure payment processing through encryption and by connecting with merchant banks and card networks.

How do I choose the best card payment machine for my business?

Selecting the right card payment machine involves considering several factors:

Transaction Fees: Evaluate if fixed or volume-based fees suit your business’s card turnover better.

Functionality & Service: Check if the machine accepts a wide range of card types and payment methods, including contactless and digital wallets, and whether it integrates well with your existing systems.

What types of card machines are available?

Countertop Machines: Ideal for fixed POS setups.

Portable Machines: Best for table service or businesses that require movement within a location.

Mobile Card Machines: Suitable for on-the-go sales, needing a stable mobile network.

Smart POS Terminals: Offer advanced features, including touchscreens and app integrations.

What are the key features to look for in a card payment machine?

When shopping for a card payment machine, look for:

Broad Payment Compatibility: Accepts various types of cards and payment methods.

Security: Offers encryption and complies with security standards.

Portability and Battery Life: Especially important for mobile businesses.

Ease of Use and Setup: Ensures minimal downtime.

Integration Capabilities: Works well with your current business systems.

How do transaction fees work with card payment machines?

Transaction fees can vary widely among providers. Some offer a fixed rate per transaction, while others may offer volume-based fees that decrease as your transaction volume increases. It’s crucial to understand how these fees align with your expected card turnover.

Can I use a card payment machine for online payments?

Yes, some card payment machines and their accompanying software support online payments, either through virtual terminals or by integrating with online stores. This allows businesses to process payments over the phone or through online sales channels.

What should I do if I experience issues with my card payment machine?

Most providers offer customer support for their card payment machines. If you encounter issues, contact your provider’s support team for assistance. For minor problems, consulting the user manual or the provider’s website may also provide quick solutions.

Final Words

Navigating the realm of card payment machines is akin to embarking on a quest for the holy grail of seamless customer transactions. In this journey, the ideal partner varies for each business, influenced by its unique needs, customer interactions, and operational model. Whether your venture thrives in a bustling brick-and-mortar setting or flourishes on the go, understanding the nuanced offerings of providers like Takepaymentsplus, Zettle, Revolut, Square, and SumUp is crucial. Each brings its own blend of technology, fees, and support to the table, aiming to bridge the gap between your business and its financial aspirations seamlessly.

In wrapping up this exploration, we invite you to share your insights or raise questions in the comments below. Have you had experiences with any of these card payment machines that have transformed your business operations? Or are you on the verge of selecting a machine and find yourself weighing the balance between cost efficiency and functionality? Your input not only enriches this discussion but also aids fellow readers in making informed decisions tailored to their business needs. Let’s continue to demystify the world of digital payments together, fostering a community where commerce meets convenience without compromise.