Imagine a world where every sale you make, big or small, is seamless and stress-free. For businesses, the ability to process payments efficiently is the lifeblood of success. In the digital age, exploring various payment methods isn’t just wise; it’s essential.

Against this backdrop, Square Payments is a popular choice for merchants, blending ease of use with comprehensive features. But what truly sets it apart in the sea of payment processors? And could it be the right fit for your business needs?

Dive into this Square Payment Review to unravel the intricacies of its service. We’ll dissect its advantages and drawbacks, scrutinise its pricing model, guide you through its setup, and answer frequently asked questions. It’s time to find out if Square holds the key to enhancing your transaction process.

Understanding Payments and Transactions

Understanding the intricacies of payments and transactions is essential for business owners who want to ensure that their payment processing is streamlined and customer-friendly. Square Payment, a popular payment processor, offers competitive transaction fees tailored to different business needs. For physical, in-person payments, Square charges a fee of 2.6% plus 10 cents per transaction. Online payments, on the other hand, incur a slightly higher fee of 2.9% plus 30 cents. These flat-rate fees are designed to help businesses easily reconcile their accounts at the end of each business day.

Square for Retail, which caters to the nuanced needs of retail businesses, follows a similar fee structure, charging 2.5% plus 10 cents for in-person transactions and 2.9% plus 30 cents for online transactions. The service not only processes payments but also includes a suite of retail functions, making it a comprehensive solution for retail business owners.

Additionally, Square provides other services designed to fit the varied transaction volumes and business sizes. Invoicing costs are kept transparent at 2.9% plus 30 cents per online payment, while the Loyalty program starts at $45 per location each month, accommodating businesses that want to encourage repeat customers.

One of Square’s standout features for business owners is the effortless end-of-day reconciliation facilitated by its flat transaction fee system, which simplifies the complexity typically associated with payment processing. Moreover, the Square App Marketplace offers a wide range of third-party integrations, enabling businesses to tailor and amplify their payment processing capabilities – be it through additional hardware like the magstripe reader and chip reader or through custom-built applications for their unique needs.

The importance of efficient payment processing for businesses

In today’s fast-moving economy, efficient payment processing is not just a convenience but a necessity for businesses. It directly impacts the customer experience – offering a wide range of payment options, including credit card payments, mobile payments, and contactless payments, can significantly enhance customer satisfaction.

For businesses, having a reliable partner like Square Payments can mean the difference between a smooth transaction and a missed opportunity. With the ability to process payments quickly and the convenience of immediate access to funds within one to two business days (depending on automatic payment settings), business owners can maintain steady cash flow.

Moreover, diversifying payment processors can serve as a risk mitigation strategy, so enumerating options like Square Payments, Payment Gateways, and traditional payment methods can offer resilience to the business’s financial operations. What’s crucial is ensuring that different payment processors are compatible and function harmoniously, routing payments accurately and securely.

Keeping a close watch on all transactions is crucial. By monitoring transaction volumes during peak business hours, customer service interactions, and payment methods used, businesses can fine-tune their payment processing systems for optimal performance.

Overview of different payment methods and their benefits

Businesses today have a myriad of payment methods at their disposal, each with unique benefits designed to suit different customer preferences and business models. Square provides business owners a comprehensive selection of person-to-person transactions including card-present transactions for face-to-face interactions, card-not-present for remote dealings, card-on-file for recurring payments, and ACH payments for direct bank transfers. Additionally, Square invoices and online payments cater to those who prefer digital platforms for making transactions.

Payment options such as Square offer not only basic payment processing but also additional features like inventory management, customer directory access, and advanced analytics, all within a centralised system. For those needing more specialised services, plans are available that can provide more advanced features, tailored for high-volume businesses or niche industry needs, including those in retail and restaurants.

Looking beyond Square, other payment providers also offer compelling benefits. For instance, Braintree is celebrated for its robust recurring billing system, international payment capabilities, and advanced fraud protection tools suitable for online and mobile business models. Adyen, with its multi-currency and multi-method payment solutions, shines in revenue optimisation, sophisticated risk management, and actionable data analytics, important for businesses with a global customer base and those looking to leverage payment data for strategic insights.

Lastly, Square’s customer management tools afford businesses the ability to easily reach out to their customers with marketing efforts, utilise analytics, and collect feedback – a crucial aspect of customer service that can drive loyalty and repeat business.

Each payment method or service provider comes with its unique set of abilities to handle various payment types and to cater to different business sizes, making the decision of which to choose highly dependent on the specific needs of the business. It’s essential for business owners to understand the transaction fees, hardware costs, and services provided to select the payment provider that best matches their transaction volumes and customer payment preferences.

Square Payments overview

Square Payments offers a well-regarded, all-encompassing payment processing solution that stands out for its simplicity and robust feature set, tailored primarily for small business owners. This platform goes beyond accepting credit card payments; it equips merchants with a seamless way to handle a variety of payment types including contactless and mobile payments, magstripe, and chip cards.

The integration of payment processing with Square’s POS system means that business operations, from managing transaction volumes to generating invoices, can be conducted within a single ecosystem. This level of integration is a boon for new merchants who favor a straightforward setup with minimal initial investment—Square even provides a free magstripe reader, reducing hardware costs.

However, Square Payments operates within its own ecosystem, an aspect that businesses must take into consideration. While Square excels in servicing smaller businesses, higher-volume businesses or those with more complex needs might find the features lacking as they scale.

In summary, Square Payments is a powerful tool for emerging and evolving businesses, valued for its ease of use, transparent pricing, and the consolidation of multiple business functions into one platform.

Pros and cons

Pros

- User-Friendly: Square’s interface is designed for simple navigation, ensuring a straightforward setup for business owners.

- Diverse Payment Options: The system caters to various payment types, including contactless and card payments, increasing customer convenience.

- Transparent Pricing: With clear transaction fees and no long-term contracts, businesses of all sizes can easily manage finances.

- Quick Fund Access: Merchants typically receive funds within one business day, boosting cash flow for efficient operations.

Cons

- Additional Hardware: Full functionality may require extra equipment, like magstripe or chip readers, which could increase costs.

- Occasional Glitches: Some users report technical hiccups with Square’s app or hardware, which could temporarily disrupt sales.

- Customer Service Hurdles: In times of high-volume inquiries, reaching prompt and effective customer support might be challenging.

- Unexpected Holds: There may be delayed transactions or fund holds, potentially disrupting business transactions.

Summary:

While Square Payments stands out for its ease of use and transparent fee structure, business owners should consider additional hardware and be aware of possible technical challenges and customer service limitations.

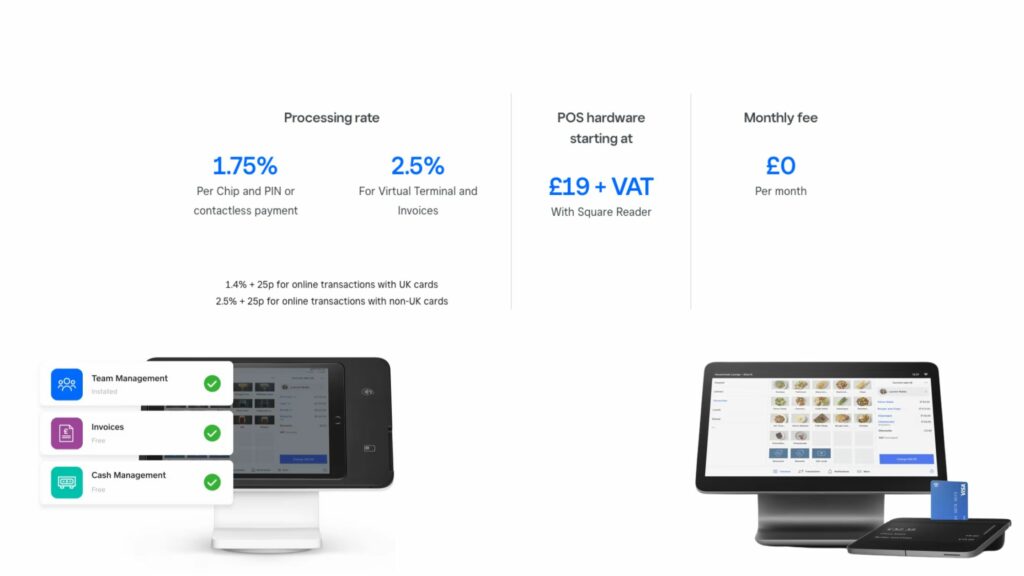

Pricing

Square’s pricing structure caters to a diverse array of business sizes and types by offering straightforward and competitive fees for its payment services. Without requiring long-term contracts or setup fees, Square provides a free basic plan that is ideal for small to medium-sized businesses looking to process payments efficiently. The standard processing fee for swiped or chip card payments is 2.6% plus 10 cents per transaction, allowing business owners to quickly know what they’re paying per sale.

For businesses with additional needs, Square offers tiered software subscriptions. The fees for these advanced services range from $29 to $69 monthly, on top of the usual processing fees, equipping higher-volume businesses with more sophisticated tools for inventory and employee management.

Square’s transaction fees are transparent, charged as a flat rate percentage plus a fixed fee, depending on the payment type—this includes online payments, contactless payments, and mobile payments. Additionally, Square distinguishes itself from many other payment processors by not imposing a chargeback fee, reducing the financial burden on merchants.

Funds are typically transferred to the merchant’s bank account within one to two business days, providing a reliable cash flow, with the possibility of same-day transfers influenced by the merchant’s banking institution’s processing capabilities.

Square Payments Setup Guide

Square Payments Setup Guide

Setting up Square Payments is a smooth process designed with business owners in mind. Here’s a quick guide:

Customise card: Jumpstart your card payments by configuring the card.html javascript file for a tailored experience.

No Waiting Time: Sign up for the free Square Payments platform, ideal for small businesses eager to accept payments immediately.

Free Online Checkout Links: Enhance your sales flow with free checkout links. No hidden fees—just efficient customisation and integration.

Virtual Terminal Access: Process payments from any location using Square’s Virtual Terminal, compatible with all operating systems.

Easy Steps to Get Started with Square:

Sign Up: Register your business without delay.

Configure Payment Page: Personalise your card.html.

Activate Checkout Links: Use the provided online checkout links for seamless transactions.

Process Payments: Utilise the Virtual Terminal for remote card entries.

Square Payments ensures business of all sizes can handle transactions secure and without long-term contracts. Plus, their attentive customer service is available during business hours to assist with any inquiry, from transaction fees to choosing the right additional hardware for contactless or chip card payments.

FAQ

What features do Square Payments offer?

Square Payments provides users with instant setup, free invoicing software, and efficient chargeback management.

How does Square Payments rate among merchant service providers?

It has an impressive overall score of 4.42 out of 5, excelling in areas like free payment processing and competitive transaction fees.

Who will benefit most from Square Payments?

It’s best suited for new and occasional sellers who process under $10,000 monthly, as its transaction fees are attractive for small-scale operations.

Why might high-volume businesses not prefer Square Payments?

Businesses with high transaction volumes or larger ticket sizes might find the transaction fees comparatively higher, which may not be economical in the long run.

Are there any reported issues with Square Payments?

Some customers have reported concerns with account stability, including instances of frozen funds and inconsistencies between terminal balances and dashboard balances.

Remember, despite the occasional account stability issue, Square Payments remains a strong contender in the payment processing arena, particularly for small businesses and solo entrepreneurs.

Final Words

Square Payments has established itself as a reliable and efficient payment provider, receiving a commendable overall rating of 4.7 out of 5 from a substantial number of 2,314 reviews. Its success is attributed to the exceptional value for money, robust features, ease of use, and outstanding customer support that users have consistently highlighted. Praised across various industries ranging from retail to nonprofit organisation management, Square stands out for its universal appeal.

What truly resonates with customers is the seamlessness of credit card payments, notably in-person transactions, and Square’s transparent transaction processes. Such ease of access is critical for businesses of all sizes and types, whether one is engaging in mobile or contactless payments.

Over its 12 years of service, Square has earned a reputation for its unwavering dependability and a high level of security, assuring business owners and their customers alike. Additionally, Square’s commitment to ongoing innovation ensures that they are always at the forefront, evolving to refine the user experience.

In summary, for reliable, straightforward, and secure payment processing, from handling chip cards to providing person-to-person payments, Square Payments stands as a top-tier option worthy of consideration.

| Area of Strength | Customer Feedback |

|---|---|

| Value for Money | Excellent |

| Features | Robust |

| Ease of Use | User-Friendly |

| Customer Support | Outstanding |