In a world where plastic often triumphs over paper, finding the right partner to process transactions can be pivotal for businesses. PayPal, a titan in the digital payment arena, has extended its reach to the physical point of sale with PayPal Zettle. But what exactly is this device, and how does it fit into the panorama of financial tools available to merchants today?

PayPal Zettle emerges as a compact solution, integrating distinctive features, transparent pricing schemes, and a balance of advantages and limitations for discerning business owners. Its holistic approach marries the convenience of modern technology with the reliability of a trusted brand. This article will delve into the world of PayPal Zettle, dissecting its various aspects to illuminate where it excels and where it might fall short.

From exploring its unique selling points to sizing it up against its competitors, we will piece together a comprehensive picture of PayPal Zettle. Alongside a curated FAQ section, this journey through the nitty-gritty of PayPal’s card reader will conclude with final words to guide you in making an informed decision about its place in your business.

What is PayPal Zettle?

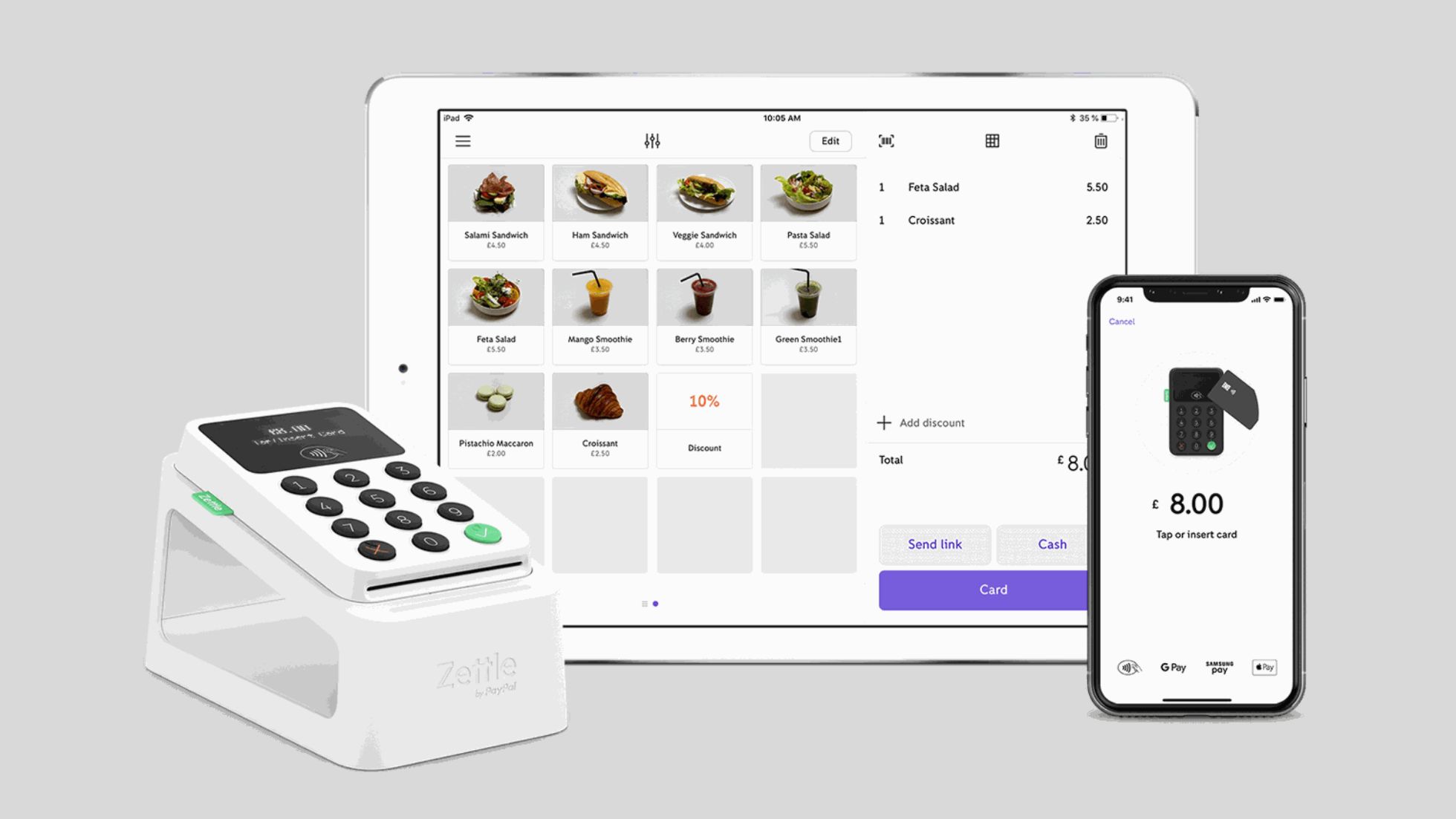

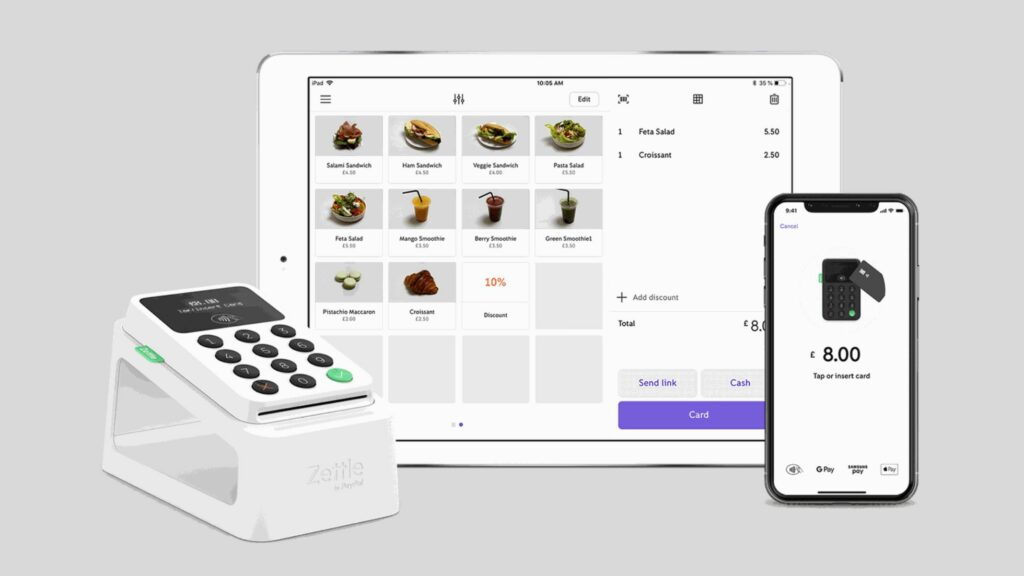

PayPal Zettle offers a dynamic point-of-sale (POS) solution that caters to the needs of modern merchants who wish to accommodate a wide spectrum of payment methods. As a product of the well-known financial technology company PayPal, Zettle simplifies the process of accepting payments from various sources including PayPal, credit cards, debit cards, and mobile payment apps such as Apple Pay and Google Pay. It’s designed to facilitate fast, easy transactions, giving business owners the flexibility to conduct sales smoothly.

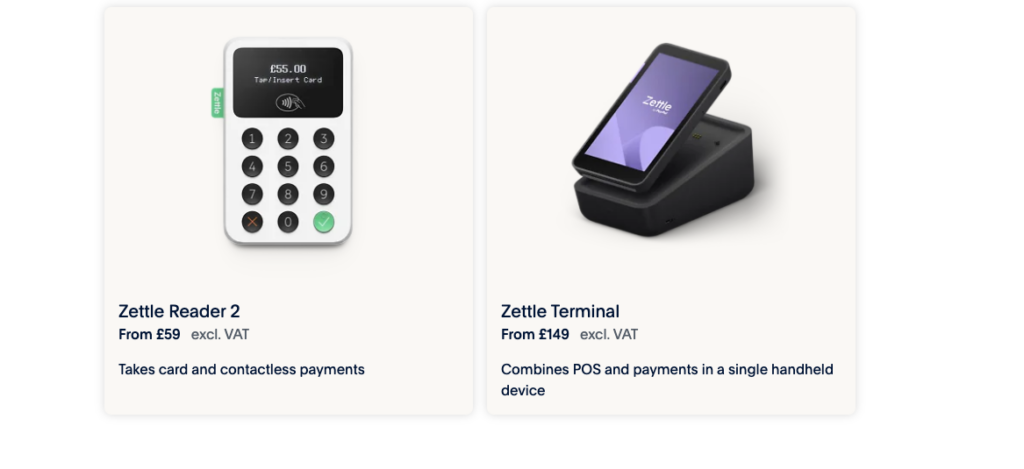

When business owners opt for PayPal Zettle, they acquire a comprehensive sales solution that integrates seamlessly with a PayPal Business account, ensuring rapid access to funds. Starting with a competitive offer, the first Reader 2 is accessible at a cost-effective price of £29, and any additional card readers are available at £59 each. Transactions are processed with a fee of 1.75%, which is a small price to pay for the convenience offered.

The setup process is straightforward: register the business, buy the card reader, and download the Zettle app to pair with a mobile device such as a smartphone or tablet. Once set up, business owners can start accepting payments and see their earnings deposited into their PayPal Business account promptly.

PayPal Zettle has retired the older, triangle-shaped card readers that were associated with PayPal Here and has introduced newer, more advanced readers to better suit their clientele’s evolving POS needs. By adopting PayPal Zettle, merchants are upgraded to an advanced, reliable, and user-friendly system for in-person transactions.

Features

Security and functionality come hand-in-hand with the PayPal Zettle system. The end-to-end encryption ensures that all transactions are secure, giving both merchants and customers peace of mind. Additionally, the card reader associated with PayPal Here boasts an encrypted design that safeguards sensitive payment information.

The PayPal Here app doesn’t just process payments; it also helps merchants enhance their sales experience. Business owners can customise settings to automatically calculate sales tax, apply discounts, and even suggest tip amounts at checkout. This level of customisation, matched with the app’s intuitive design, makes day-to-day operations simpler and more efficient.

For those accepting payments via QR codes, PayPal Here supports Venmo and PayPal transactions, providing customers with the convenience of choosing their preferred digital payment method. Keeping the card reader operationally ready is a breeze. It charges easily via USB, connected to either a plug adapter or a computer, and a single full charge can sustain the card reader through up to 100 transactions or up to 7 days of standby time.

The PayPal Card Reader is designed to provide businesses with a flexible and convenient way to accept payments, whether you’re operating in-store, online, or on the go. Here are some of its key features:

Multiple Payment Options: Accepts a wide variety of payment methods including chip and PIN, contactless, and mobile payments through Apple Pay and Google Pay.

Compatibility with PayPal: Seamlessly integrates with your PayPal account, enabling easy management of funds and transactions.

Portability: Compact and designed for mobility, making it suitable for businesses that operate both in physical locations and at events or pop-up shops.

Secure Transactions: Adheres to high security standards with encryption to protect customer data during transactions.

Quick Setup: Easy to set up and start accepting payments, with no long-term commitments or monthly fees.

Real-Time Tracking: Offers access to PayPal’s comprehensive dashboard for real-time tracking of sales and payments.

Invoice Creation: Allows businesses to create and send invoices directly from the device or associated app.

Global Acceptance: Capable of accepting payments in various currencies, facilitating sales to international customers.

Reliability: Backed by PayPal’s reputation for reliability and customer service, providing peace of mind for both businesses and their customers.

Pricing

The cost of getting started with a PayPal Here card reader setup is modestly priced at £62.50 plus VAT. From there, the transaction fees scale with the merchant’s monthly sales volume, starting from 2.75% to as low as 1%—a structure that can benefit growing businesses.

For a more predictable fee model, PayPal offers a blended option, applying a consistent rate across the board, immune to fluctuations in interchange fees. Conversely, those who prefer a flexible approach might choose the interchange plus option, with a set percentage tacked onto the standard interchange rates from card issuers like Visa and Mastercard.

There are additional rates to keep in mind, particularly for manual entries or swipes of card strips, which carry a 3.40% plus 20p fee. American Express transactions processed through contactless or chip and pin are set at a rate of 2.75%. These fees are a critical consideration for businesses as they factor into overall operation costs.

| Item | Description | Rate |

|---|---|---|

| Card Reader Cost | Initial purchase price | £59 + VAT |

| Transaction Fee – Standard | Monthly sales volume: High to Low | 2.75% to 1% |

| Transaction Fee – Blended | Consistent rate across all transactions | Standard rate |

| Transaction Fee – Interchange Plus | Percentage + standard interchange rate | Standard rate + percentage |

| Manual Entries/Swipes | For non-chip transactions | 3.40% + 20p |

| American Express | Contactless/Chip and Pin transactions | 2.75% |

Pros and Cons

PayPal Here presents several advantages for businesses looking to streamline their payment systems. There’s a variety of card readers to select from, meeting the diverse technical requirements businesses might have. Its app is not only user-friendly but also highly adjustable, whether you’re keeping track of inventory or setting up the sales tax parameters.

Integration is another strong suit of PayPal Here, which can easily fit into an existing POS hardware setup, allowing for use with additional devices such as receipt printers and cash drawers. The multitude of payment methods it accepts—from major credit cards to mobile payment options like Apple Pay—demonstrates the flexibility this system offers to business owners and customers.

While PayPal Here boasts commendable customer service support, ensuring swift and reliable assistance, it is not without its limitations. There could be particular needs that it doesn’t quite meet, and the variances in transaction fees may not suit every business model. Nonetheless, for many, the pros of PayPal Here’s robust and versatile system will outweigh the cons, making it a comprehensive sale solution for a range of businesses.

Pros

- Wide Selection of Card Readers: Catering to various business needs with a range of devices.

- User-Friendly App: Easy to use for tracking inventory and managing sales tax.

- Seamless Integration: Fits into existing POS setups and is compatible with additional devices like receipt printers and cash drawers.

- Flexible Payment Acceptance: Accepts major credit cards and mobile payment options, offering convenience to customers.

- Strong Customer Service: Provides reliable support for swift assistance.

Cons

- Specific Limitations: May not meet all specialised business needs.

- Variable Transaction Fees: The scaling fees based on sales volume may not be ideal for every business model.

- Cost Considerations: Initial and ongoing costs may require careful financial planning for some businesses.

Where PayPal Zettle stands out

PayPal Zettle stands out in the competitive world of card readers and point-of-sale solutions with its comprehensive offerings. With Zettle, business owners gain access to not only advanced card readers but also a free POS software suite that enhances their sale solution. The card readers are capable of handling various forms of payment such as chip cards and contactless payments, including mobile payments like Google Pay and magnetic stripe cards. This includes support for major credit and debit cards, such as American Express.

What truly sets PayPal Zettle apart is its cost-effectiveness. Merchants benefit from a low, flat transaction rate of just 1.75%, without the burden of monthly fees or hidden costs. Furthermore, processing fees are notably competitive at 2.29% + $0.09. Another advantage is the speed at which funds become available – transactions made with Zettle typically allow funds to appear in a user’s PayPal balance within minutes, granting swift access to earnings.

Even as PayPal transitions from its PayPal Here system, current users can rest assured as they can continue operating smoothly using the PayPal Here mobile app.

| Feature | PayPal Zettle |

|---|---|

| Monthly Fees | None |

| Hidden Costs | None |

| Flat Transaction Rate | 1.75% |

| Processing Fees | 2.29% + $0.09 |

| Funds Availability | Minutes |

PayPal Zettle doesn’t just process payments; it facilitates a seamless, efficient, and affordable payment experience for both business owners and their customers.

Alternatives to PayPal Zettle

When exploring alternatives to PayPal Zettle for your business payment solutions, there are several options that cater to different needs. PayPal Here is one such alternative designed for small business owners. While it’s less competitive in transaction fees for lower earners, at 2.75% for monthly sales under £1,500, it’s a worthy consideration for businesses with mini sales volumes.

However, PayPal Here has some limitations. It accepts only the primary card brands which may restrict some customers who use less common cards, and it requires a compatible mobile device – specifically an iPhone or Android with at least Bluetooth 2.0 capabilities. Unfortunately, users with Windows phones are not able to use PayPal Here due to compatibility issues.

Those who opt for PayPal Here should also be ready to make transactions without Windows phone compatibility or the versatility offered by some other card reader devices. For businesses looking for a broad range of payment options including chip cards, contactless, and mobile payments such as Google Pay, Zettle by PayPal offers the Zettle Reader 2. This device boasts a handy USB charging feature with a robust battery life of up to 8 hours, ensuring uninterrupted transaction processing throughout the business day.

Frequently Asked Questions

What is PayPal Zettle?

PayPal Zettle is a dynamic point-of-sale (POS) solution that accommodates a wide spectrum of payment methods, including credit cards, debit cards, PayPal, and mobile payment apps like Apple Pay and Google Pay. It’s designed for modern merchants who need fast, easy transaction processes.

How does PayPal Zettle pricing work?

PayPal Zettle offers competitive pricing with the first Reader 2 priced at £29, and additional card readers at £59 each. Transactions are processed with a fee of 1.75%. There’s also a choice between a blended fee model or an interchange plus option for transaction fees.

What are the key features of PayPal Zettle?

Key features include:

Multiple payment options including chip and PIN, contactless, and mobile payments.

Seamless integration with PayPal accounts.

Compact and portable design for mobility.

High security with end-to-end encryption.

Quick setup and real-time sales tracking.

How do I get started with PayPal Zettle?

To start using PayPal Zettle, register your business, purchase the card reader, and download the Zettle app. Pair the app with a mobile device, and you’re ready to accept payments directly into your PayPal Business account.

Are there any limitations to using PayPal Zettle?

While PayPal Zettle is known for its convenience and user-friendly app, it may have limitations in accepting less common card brands and requires a compatible mobile device for operation. Windows phone users might face compatibility issues.

How does PayPal Zettle compare to PayPal Here?

PayPal Zettle is an upgrade from the older PayPal Here system, offering more advanced readers and features to suit evolving POS needs. It stands out for its cost-effectiveness and quick access to funds, although PayPal Here may still be considered by some businesses for its unique features.

Can PayPal Zettle handle various forms of payment?

Yes, PayPal Zettle can process payments from a broad range of sources, including major credit and debit cards, contactless payments, and mobile payment applications such as Apple Pay and Google Pay.

What are the alternatives to PayPal Zettle?

Alternatives include PayPal Here for small businesses with mini sales volumes. While it offers lower transaction fees for monthly sales under £1,500, it may not support as many card brands and requires a compatible iPhone or Android device.

Final Words

The PayPal Here Card Reader embodies a compact and versatile solution for on-the-go business owners seeking an efficient sale system. As we embrace a digital economy, accommodating diverse payment methods becomes crucial. This device not only streamlines transactions but also extends convenience to both merchants and customers by supporting an array of payment options, including chip & PIN, contactless, and traditional swipe methods. With major card providers like VISA, Mastercard, Maestro, and American Express on the compatibility list, the reluctance of customers without cash is a concern of the past.

Equipped for modern commerce, the PayPal Here Card reader connects effortlessly to a mobile device via Bluetooth, provided the PayPal Zettle app is installed—transforming your smartphone into a powerful point-of-sale terminal. Connectivity is key, and a stable internet connection, preferably through a robust WiFi network or adequate mobile data, is necessary to ensure sales are processed swiftly, granting customers that gratifying green light of transaction approval without unnecessary delay.

It is an indispensable addition to any merchant’s toolkit, especially for those navigating the bustling environment where expeditious and reliable card payments are the norm. With the PayPal Here Card Reader, the focus can remain on what truly matters—the growth and prosperity of your business.